Evening Star: A Signal That Sellers Are Stepping In

Last updated

Table of Contents

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always do your own research before making investment decisions.

Overview of the Evening Star Pattern

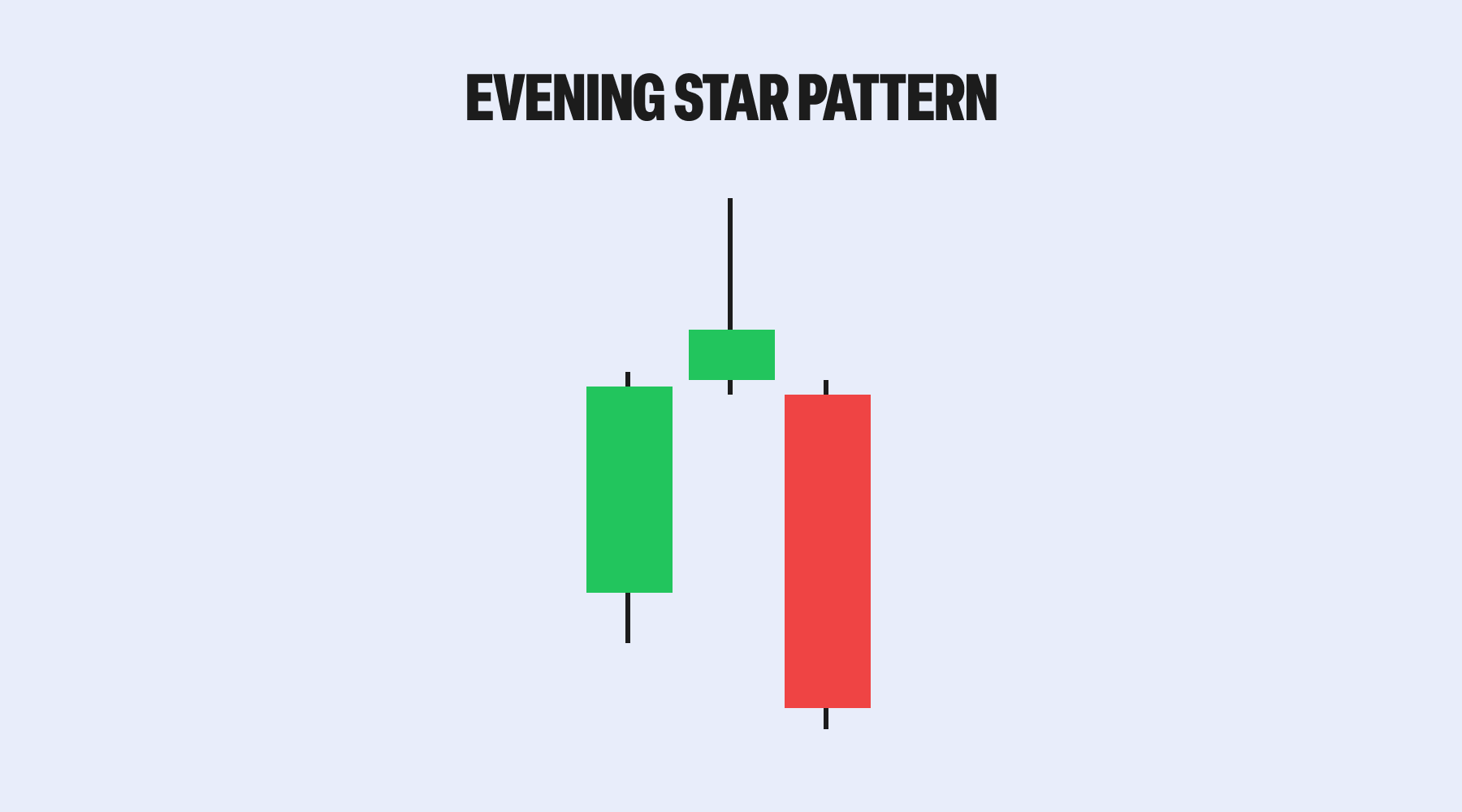

The Evening Star is a three-candle reversal pattern that forms after a rally in price. It signals that bullish momentum is fading and that sellers may be regaining control.

It typically unfolds over three sessions:

- A long green candle showing strong buying pressure.

- A small-bodied candle indicating indecision.

- A strong red candle confirming the shift in momentum.

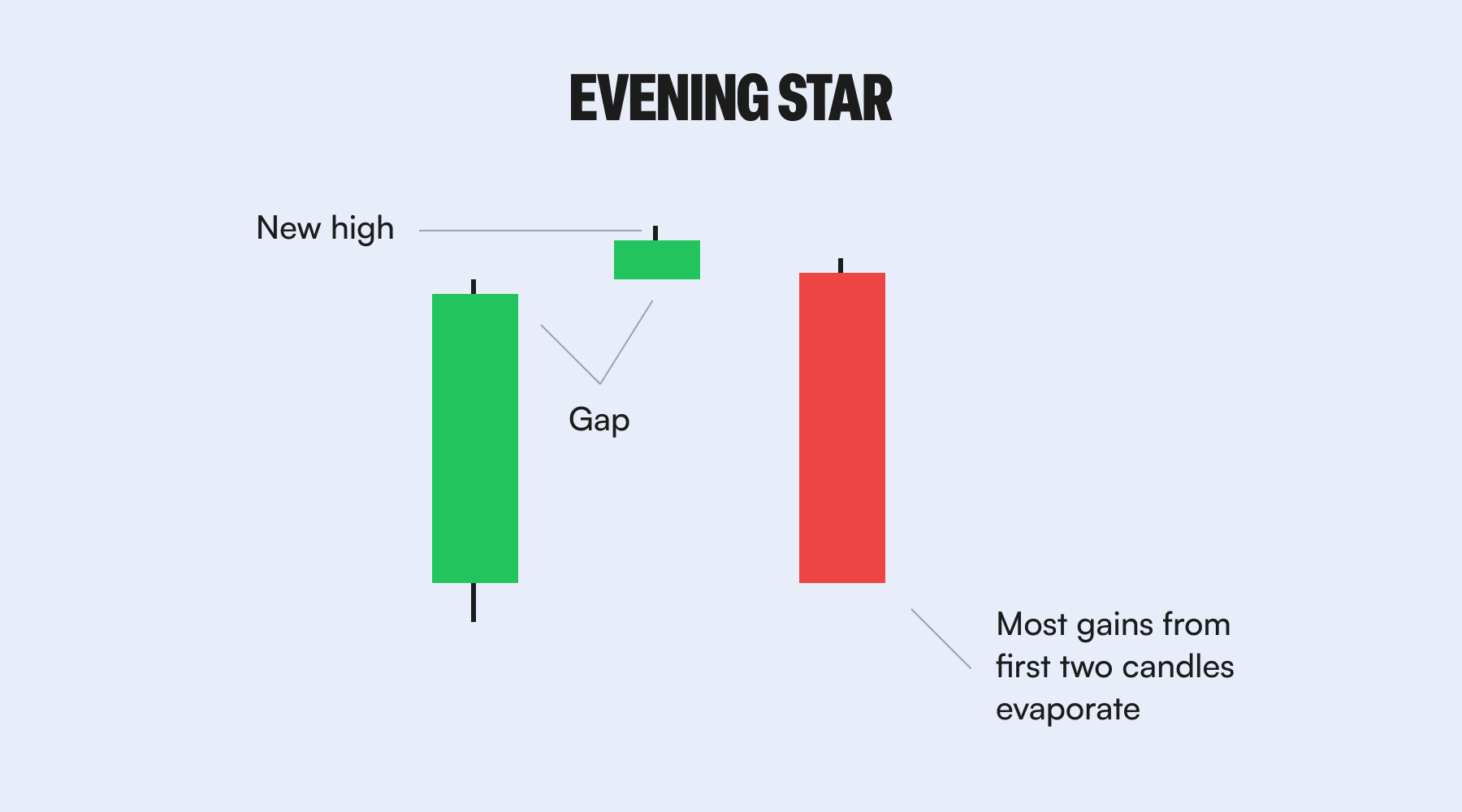

When spotted at the top of an uptrend or near a key resistance zone, the Evening Star can be a powerful early signal for a potential price reversal to the downside.

What Does It Look Like?

The Evening Star pattern has three distinct parts:

- Candle 1: Bullish candle - A large green candle closes near its high, continuing the current uptrend.

- Candle 2: Indecision candle - A small-bodied candle (green, red, or doji) shows hesitation in the market. The price movement stalls, suggesting that buyers may be losing strength.

- Candle 3: Bearish candle - A strong red candle closes well into the body of the first candle - ideally below its midpoint. This confirms that sellers have stepped in with force.

The pattern resembles an upside-down U and reflects a transition from bullish dominance to bearish momentum.

The Evening Star is more reliable when it forms at a major resistance level or after a sharp price increase.

How Traders Use the Evening Star Pattern

Crypto traders use the Evening Star to anticipate potential trend reversals and manage their trades. Here’s how:

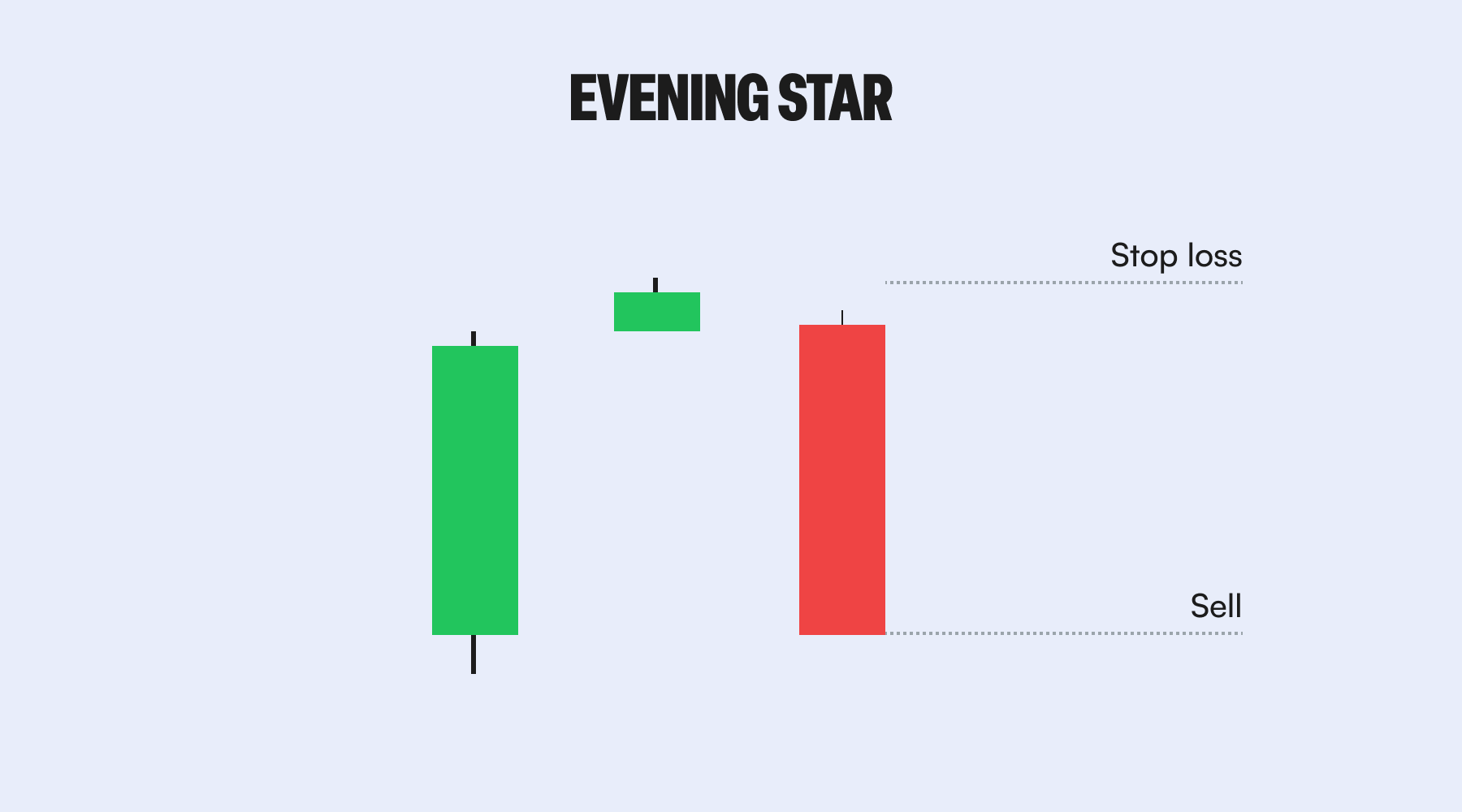

- Exit point - Traders already in long positions may use the pattern as a signal to take profit or reduce exposure.

- Short entry - Some traders place a sell order below the low of the third candle. This confirms that sellers are in control.

- Stop-loss placement - A common stop level is just above the high of the second candle. This protects against false signals.

- Confirmation tools - To increase confidence, traders often combine the pattern with volume spikes on the third candle, key resistance zones, and indicators like RSI or MACD.

When these elements align, the Evening Star becomes a high-conviction setup for bearish reversals.

Example in Crypto Markets

Imagine Bitcoin has been rallying for several days. Then the following forms on the daily chart:

- A large green candle closes near its high.

- A small-bodied candle appears the next day, signaling hesitation.

- A strong red candle follows, closing below the midpoint of the green candle.

This is a textbook Evening Star. If price breaks below the red candle’s low the next day - especially with volume - it confirms that bearish momentum may be taking over.

Traders may go short with a stop-loss above the small candle’s high and target previous support levels for exits.

Limitations of the Pattern

Like all candlestick patterns, the Evening Star isn’t foolproof. It works best when combined with other forms of analysis and has some key limitations:

- It can produce false signals in sideways or choppy markets.

- Without volume confirmation, the pattern may be weak.

- It may not work well in isolation - always consider the broader trend and market context.

Proper risk management is essential. Use stop-losses and position sizing to protect against unexpected moves.

Conclusion

The Evening Star is a classic bearish reversal pattern that gives crypto traders a visual cue that momentum may be shifting. It’s simple to recognize and, when confirmed with volume and resistance levels, can signal high-probability trade setups.

Because of its clarity and usefulness, the Evening Star remains a go-to signal for spotting market tops and preparing for trend reversals.

Next Steps

- Learn about the Morning Star, the bullish counterpart of the Evening Star, in our previous article.

- Explore related bearish reversal patterns like the Bearish Engulfing and Shooting Star candlesticks.

- Practice identifying Evening Star patterns on live crypto charts.

- Combine candlestick signals with technical indicators such as RSI, MACD, and moving averages for stronger confirmation.

By incorporating the Evening Star pattern into a well-rounded strategy with confirmation tools and risk controls, traders can improve their ability to react to market reversals with greater confidence.

Explore Related Articles:

- A Beginner’s Guide to Candlestick Charts

- Rising Bullish Hammer Candlestick Pattern Explained

- Shooting Star (Falling Hammer) Candlestick Pattern Explained

- Bullish Engulfing: A Signal That Buyers Are Taking Over

- Bearish Engulfing: A Signal That Sellers Are Taking Control

- Morning Star Pattern: A Signal That Buyers Are Stepping In

- Golden Cross: A Signal That Bullish Momentum Is Building

- Bearish (Death) Cross: A Signal That Momentum May Be Turning Against the Market

- Pi Cycle Top: A Signal That Bitcoin May Be Peaking

- What Is the MACD Indicator? A Guide to Moving Average Convergence Divergence in Crypto

- Relative Strength Index (RSI): Spotting Overbought and Oversold Markets

- Stochastic Oscillator: Measuring Momentum and Spotting Reversals

Get started by understanding the basics of cryptocurrency and explore decentralized finance (DeFi). Learn about Bitcoin, Ethereum, and altcoins. Also, discover how to buy and sell crypto.

Disclaimer

No Investment Advice

The information provided in this article is for educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Bitcoin.com does not recommend or endorse the buying, selling, or holding of any cryptocurrency, token, or financial instrument. You should not rely on the content of this article as a basis for any investment decision. Always do your own research and consult a licensed financial advisor before making any investment decisions.

Accuracy of Information

While we strive to ensure the accuracy and reliability of the information presented, Bitcoin.com makes no guarantees regarding the completeness, timeliness, or accuracy of any content. All information is provided “as is” and is subject to change without notice. You understand that you use any information available here at your own risk.

Related guides

Start from here →

What is a Decentralized Exchange (DEX)?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

What is a Decentralized Exchange (DEX)?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

What is a Centralized Exchange (CEX)?

Learn about CEXs, the differences between them and DEXs, and whether they’re safe to use.

What is a Centralized Exchange (CEX)?

Learn about CEXs, the differences between them and DEXs, and whether they’re safe to use.

How does crypto exchange work?

How safe is it to store your crypto on centralized exchanges?

How does crypto exchange work?

How safe is it to store your crypto on centralized exchanges?

Bitcoin Trading for Beginners

A comprehensive guide to Bitcoin trading for beginners, covering wallets, exchanges, market analysis, and risk management strategies.

Bitcoin Trading for Beginners

A comprehensive guide to Bitcoin trading for beginners, covering wallets, exchanges, market analysis, and risk management strategies.

Reading Bitcoin Charts for Beginners

A beginner's guide to understanding Bitcoin charts, covering candlestick patterns, technical indicators, market analysis, and risk management.

Reading Bitcoin Charts for Beginners

A beginner's guide to understanding Bitcoin charts, covering candlestick patterns, technical indicators, market analysis, and risk management.

Bull vs Bear Market Explained

Learn what defines bull and bear markets, how investor behavior shifts in each phase, and how Bitcoin historically moves through market cycles.

Bull vs Bear Market Explained

Learn what defines bull and bear markets, how investor behavior shifts in each phase, and how Bitcoin historically moves through market cycles.

Trading Analysis: Fundamental, Technical & Sentimental

Learn about fundamental, technical, and sentimental analysis for smarter trading decisions. Explore examples, tools, and how to combine these methods for a holistic market view.

Trading Analysis: Fundamental, Technical & Sentimental

Learn about fundamental, technical, and sentimental analysis for smarter trading decisions. Explore examples, tools, and how to combine these methods for a holistic market view.

STAY AHEAD IN CRYPTO

Stay ahead in crypto with our weekly newsletter delivering the insights that matter most

Weekly crypto news, curated for you

Actionable insights and educational tips

Updates on products fueling economic freedom

No spam. Unsubscribe anytime.

Start investing safely with the Bitcoin.com Wallet

Over wallets created so far

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely

© 2026 Saint Bitts LLC Bitcoin.com. All rights reserved