Exchanges

- Best Crypto ExchangesAlgorithmic Trading PlatformsNo KYC ExchangesArbitrage BotsAuto DCAAutomated TradingBinary OptionsCentralized ExchangesContract TradingCopy TradingCrypto Index TradingCrypto-to-Fiat ExchangesCrypto BrokersDay TradingDecentralized ExchangesDemo Trading AccountsDerivative ExchangesDual Investment TradingBeginner ExchangesFutures TradingGrid TradingHybrid ExchangesLending PlatformsLeverage TradingLiquidity PoolsLive TradingLowest Fees ExchangesMargin TradingMarket Making ExchangesOptions TradingP2P Crypto ExchangesPayPal Supported ExchangesPerpetual Futures TradingRecurring BuysSafest ExchangesSavings AccountsShorting ExchangesStaking Rewards ExchangesSwap ExchangesSwap PlatformsTokenized Stocks TradingZero Fee TradingCrypto OTCInsitutional TradingBitcoin OTCBitcoin OTC GuidesBitcoin Trading BotsCrypto AppsCrypto Trading AppsCrypto Trading PlatformsAutralian Crypto Trading PlatformsExchanges for BitcoinPlaces to buy CryptoUSA Bitcoin ExchangesBitcoin Trading StrategiesTradingDEX Best PracticesDeFi Best PracticesDEX OverviewDEX Tutorials

Wallets

- Best Crypto WalletsSelf-Custodial WalletsCustodial WalletsHardware WalletsMulti-Sig WalletsMobile WalletsDesktop WalletsBrowser Extension WalletsLightning WalletsDeFi Bitcoin WalletsPaper WalletsBitcoin WalletsSecure Bitcoin WalletsEthereum WalletsSolana WalletsPolkadot WalletsBNB WalletsLitecoin WalletsRipple WalletsCardano WalletsAvalanche WalletsTezos WalletsNFT WalletsDeFi WalletsStaking WalletsTrading WalletsGaming WalletsPrivacy WalletsHODL WalletsRemittance WalletsEnterprise WalletsMultichain WalletsWallet ServicesWallet Backup OptionsSecure WalletsWallet Security TipsWallet Setup GuideWallet Downloads

Casinos

- Best Crypto & Bitcoin CasinosBitcoin CasinoAltcoin CasinosCard CasinosCrypto CasinosETH CasinosGuides: CasinosGuides: Blackjack StrategyGuides: How to Play BlackjackGuides: How to Play PokerGuides: How to Play RouletteGuides: Poker StrategyGuides: Roulette StrategyTop CasinosBingoCasino BotsNo KYCArbitrum CasinosAvalanche CasinosBaccaratBase CasinosBNB CasinosBCH CasinosBitcoin CasinosBlackjackCasino BonusesCardano CasinosCluster PlaysCosmic Jackpot GamesCrapsCrashDAI CasinosDecentralized CasinosDeFi CasinosDiceDiscord CasinosDogecoin CasinosDrops and WinsEgyptian SlotsETH BonusesETH Live DealerETH No Deposit BonusesETH RouletteETH SlotsFree SpinsGalactic Slot MachinesGame ShowsHigh RollersHigh Volatility CasinosHorror Casino GamesInstant WithdrawalJackpotKenoLitecoin CasinosLive DealerMetaMask CasinosMetaverse CasinosMinesMinimum Deposit CasinosMultiplayer CasinosNewest CasinosNFT CasinosNo Deposit BonusesNorse Mythology SlotsTrump CasinosOptimisim CasinosPirate SlotsPolygon CasinosPrivacy-Focused CasinosProgressive JackpotProvably FairRespinsRouletteScatter PaysScratch CardsShiba Inu CasinosSic-BoSlotsSocial CasinosSolana CasinosStablecoin CasinosSweepstakes CasinosTON CasinosToshi CasinosTreasure Hunt SlotsTRX CasinosUSDC CasinosTether CasinosVerse CasinosVideo PokerViking Casino GamesVIPWheelRipple CasinosPachinkoLotteryMeme CasinosMobile CasinosOnline CasinosPlinkoPokerGuides: Poker FAQGuides: Poker LegalityGuides: Poker PromotionsGuides: Poker Room ReviewsGuides: Poker TournamentsTable GamesTelegram CasinosWeb3 CasinosMegaways SlotsBook of SlotsPlay Along with CryptoDaily ContestsWeekly RafflesBuy Extra Ball GamesHold and Win Slots

Sportsbooks

- Best Bitcoin SportsbooksFootballAmerican FootballNo KYCAustralian Open TennisBadmintonBaseballBasketballBetting ExchangesBonusesBoxingBundesligaChessCollege BasketballCricketICC ChampionsIndian Premier LeagueCyclingDartsEnglish Premier LeagueEsportsCall of DutyCSGODOTA-2FIFALOLStarcraftValorantWorld of WarcraftFIFA World CupIce Hockey BettingNHL Entry Draft 2025Ice Hockey World Championship 2025Formula 1French Open TennisGrand Slam TennisGreyhound RacingHandballHockeyHorse RacingKentucky DerbyLa LigaLive BettingMarch MadnessMMAMotorsportsNascarNBA DraftNFL DraftOlympicsPGAPoliticsPolitics (Trump)Politics (Kamala)US PoliticsRugbySerie ASnookerStock Car RacingSuper BowlTable TennisUFCUFC Fight NightUp vs DownUS Open TennisVolleyballWimbledonWinter SportsGolfSoccerTennis

What is DeFi?

Decentralized finance, or DeFi, is a catch-all term for financial products that live on decentralized networks like Ethereum. The basic idea of DeFi is to rely on smart contracts to automate financial products. The most widely used DeFi products currently are in the realm of borrowing and lending, trading, and derivatives.

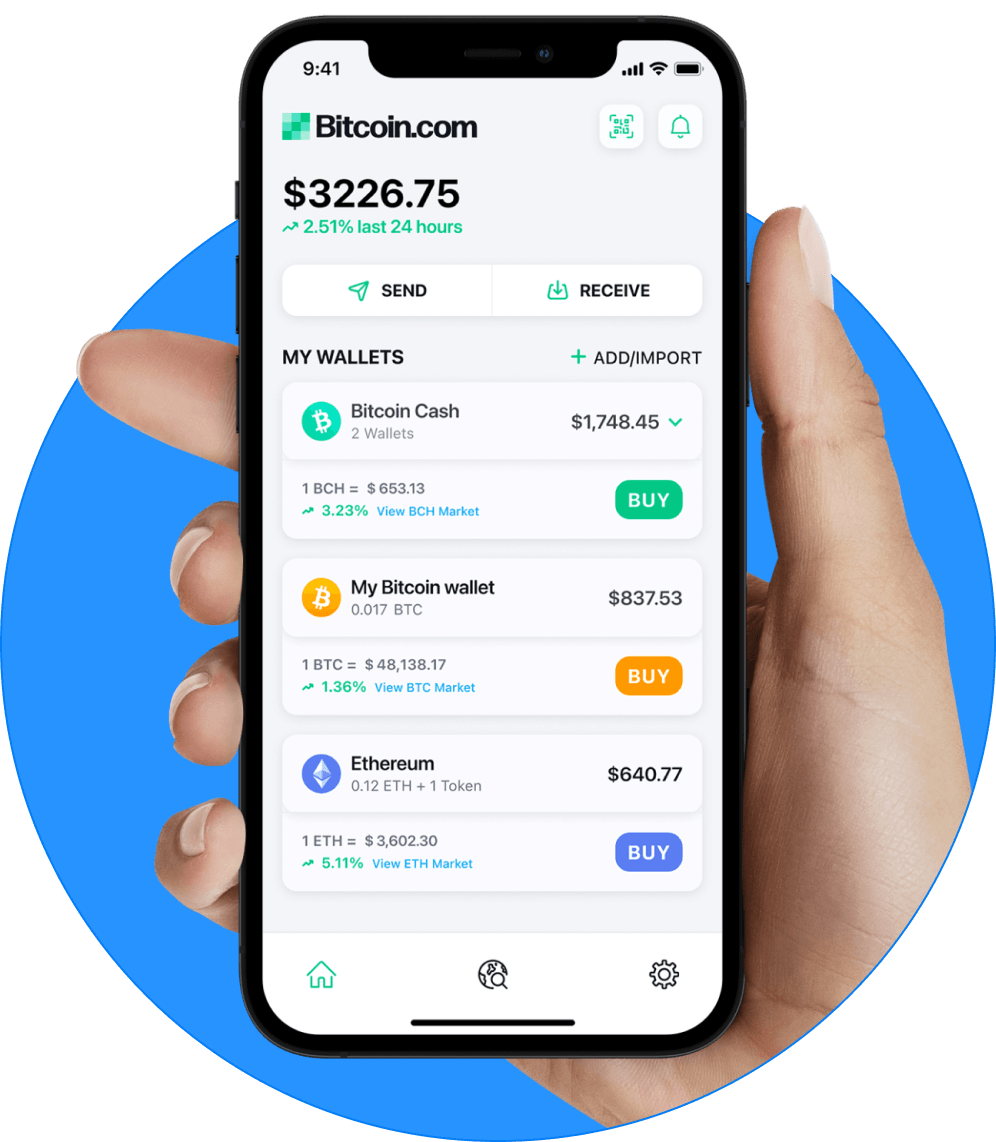

Use the multichain Bitcoin.com Wallet app, trusted by millions to safely and easily buy, sell, trade, and manage bitcoin and the most popular cryptocurrencies. The app also enables you to engage in DeFi.

Related guides

Start from here →

What is Ethereum?

Understand Ethereum's key characteristics.

What's a dApp?

Discover what dApps are, how they work, advantages and disadvantages, and more.

Read this article →

What's a dApp?

Discover what dApps are, how they work, advantages and disadvantages, and more.

Bitcoin.com in your inbox

A weekly rundown of the news that matters, plus educational resources and updates on products & services that support economic freedom

Start investing safely with the Bitcoin.com Wallet

Over wallets created so far

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely

Download now