A Beginner’s Guide to Candlestick Charts

Last updated

Table of Contents

- A Beginner’s Guide to Candlestick Charts

- What is a candlestick chart?

- Chart types: Line vs. Bar vs. Candlestick

- The anatomy of a candlestick

- What candlesticks reveal

- A note on candlestick patterns

- What candlesticks don’t show

- Heikin-Ashi: A smoother alternative

- Why candlesticks matter in crypto

- Final thoughts

- Disclaimer

A Beginner’s Guide to Candlestick Charts

Welcome to the first article in our Bitcoin.com Trading series - designed to help you understand and confidently use candlestick charts.

If you're new to trading or investing, making sense of market charts can feel overwhelming. Terms like “bullish engulfing” or “hammer pattern” often sound more confusing than useful. This series breaks everything down step by step, starting with the basics.

Candlestick charts are one of the most essential tools in a trader’s toolkit. They’re fast, visual, and packed with information - making it easier to interpret price action and spot opportunities.

By the end of this article, you’ll understand what candlestick charts are, how they work, and why they’re especially useful in crypto trading - particularly when identifying trends, reversals, and potential entry or exit points.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always do your own research before making investment decisions.

What is a candlestick chart?

A candlestick chart shows how the price of an asset moves over a specific period of time. Each “candlestick” on the chart represents a set time interval - like 1 minute, 1 hour, 1 day, or even 1 week. You’ll often hear traders refer to the time period as the “timeframe.”

Candlestick charts are used across all financial markets - crypto, stocks, forex, and more - because they quickly show whether prices went up or down, how much they moved, and where the action happened.

Candlestick charts were first developed by a Japanese rice trader named Munehisa Homma in the 1700s. The technique gained popularity in the West after being introduced by Steve Nison in his 1991 book Japanese Candlestick Charting Techniques.

Chart types: Line vs. Bar vs. Candlestick

Before we dive deeper, it helps to understand how candlestick charts differ from other common chart types:

| Chart Type | Shows | Pros | Cons |

|---|---|---|---|

| Line | Only closing prices | Simple, clean view of overall trend | Lacks detail |

| Bar | Open, High, Low, Close | More data-rich than line charts | Harder to read quickly |

| Candlestick | OHLC with color-coded bodies | Visual, intuitive, easy to spot patterns | Can be noisy on lower timeframes |

Most crypto traders prefer candlestick charts because they offer the best of both worlds - visual clarity and detailed price data.

While bar charts show the same key price points - the open, high, low, and close - candlestick charts are generally easier to read and more intuitive. That’s why most traders, especially in crypto, use candlesticks to spot trends, reversals, and key trading signals more confidently.

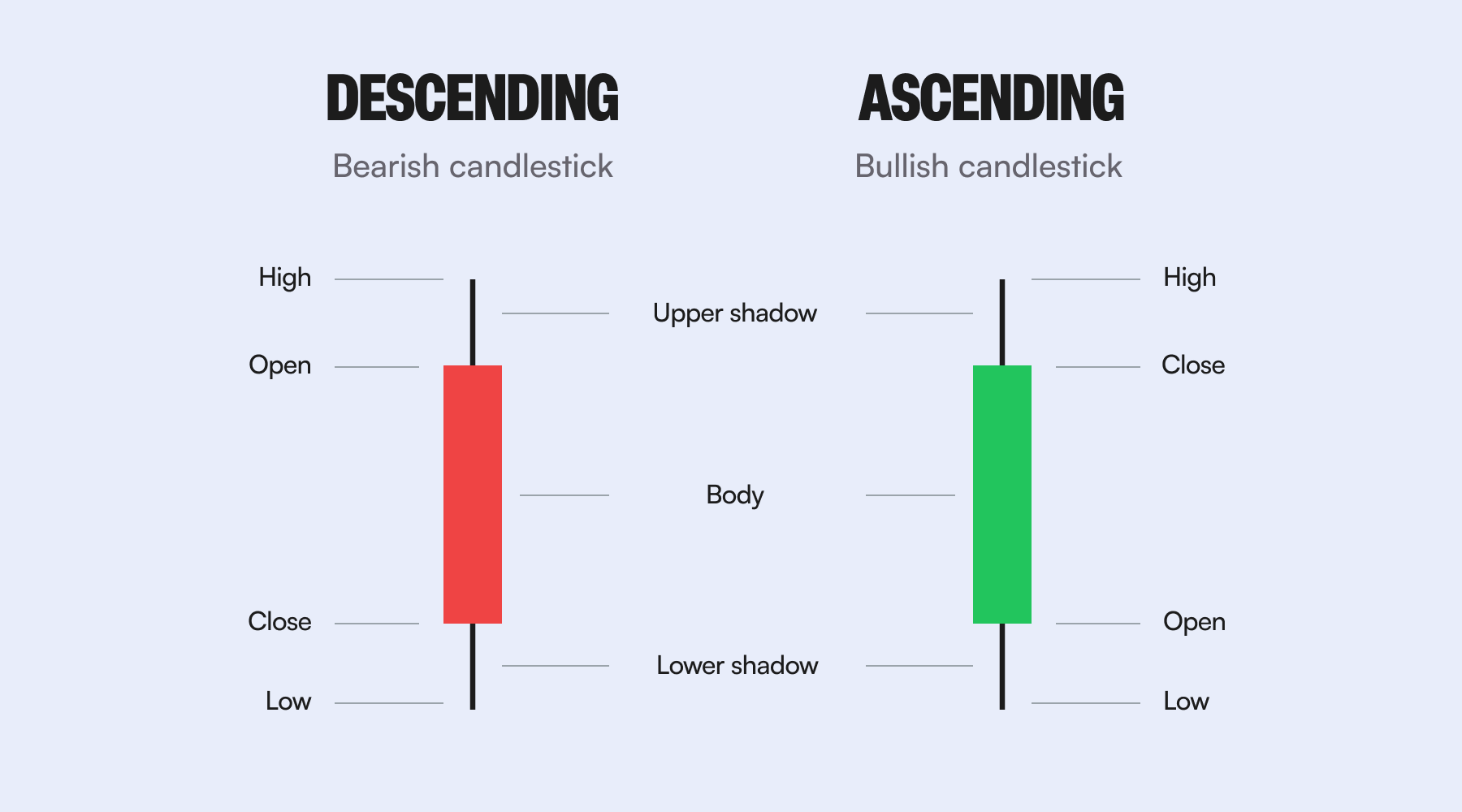

The anatomy of a candlestick

Each candle tells a story through four key data points:

- Open: the price at the start of the timeframe

- High: the highest price reached

- Low: the lowest price reached

- Close: the price at the end of the timeframe

Together, these are called OHLC data.

The candle is made up of two main parts:

- The body: shows the difference between the open and close

- The wicks (or shadows): show how high and low the price went during the timeframe

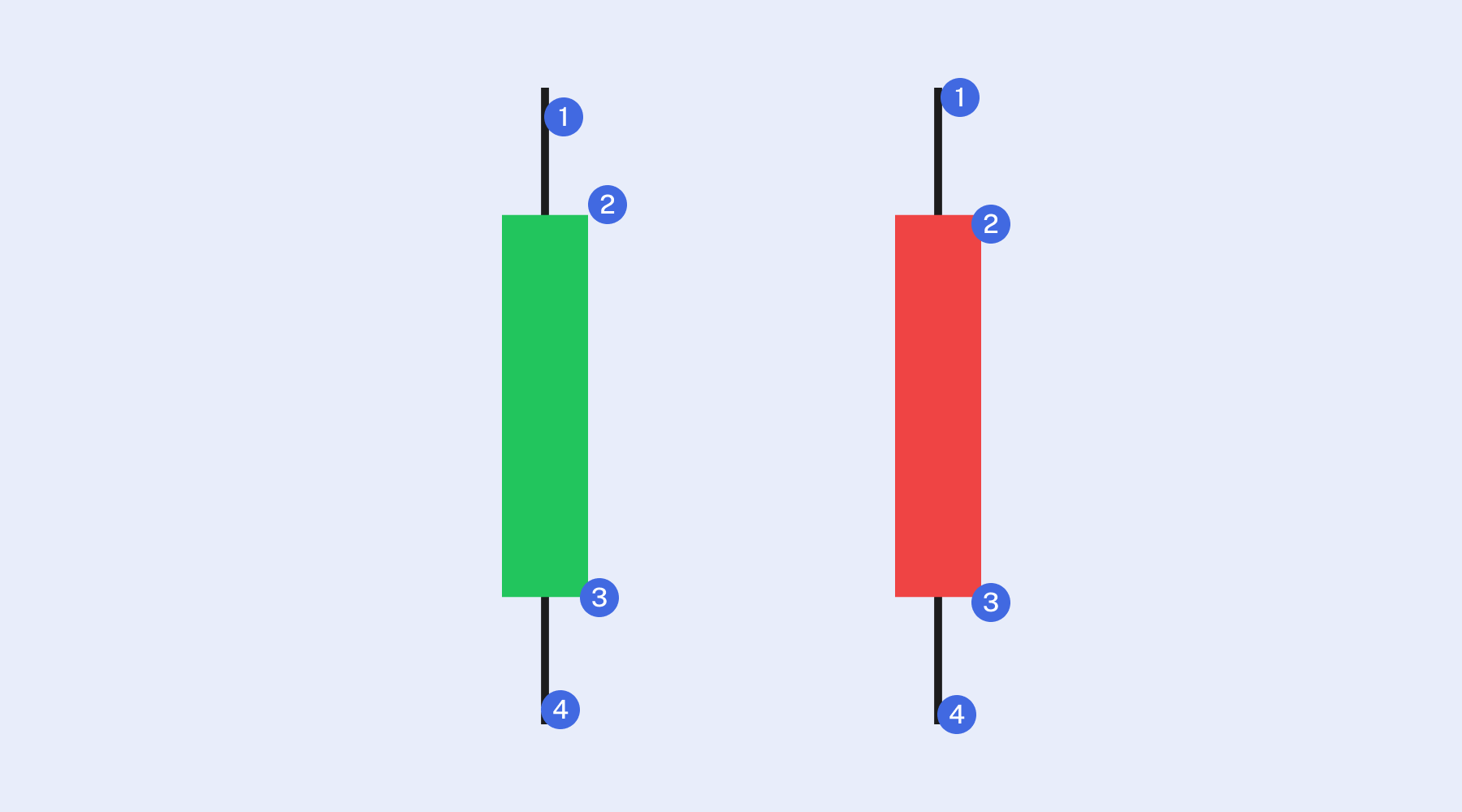

| Descending candlestick | Ascending candlestick | |

|---|---|---|

| Upper wick: highest traded price in that period. | 1 | Upper wick: highest traded price in that period. |

| Open: first traded price in that period. | 2 | Close: last traded price in that period. |

| Close: last traded price in that period. | 3 | Open: first traded price in that period. |

| Lower wick: lowest traded price in that period. | 4 | Lower wick: lowest traded price in that period. |

If the close is higher than the open, the candle is usually green (bullish). If the close is lower, the candle is red (bearish). Some charting platforms use white and black candles instead.

Sometimes, only one wick is visible. That happens when the open or close is the same as the high or low - meaning one edge of the candle aligns exactly with the top or bottom of the range.

What candlesticks reveal

Candlesticks form one after another on the chart, creating a visual history of price movement. Here’s what you can spot at a glance:

- Long green candles - strong buying pressure

- Long red candles - strong selling pressure

- Small bodies with long wicks - indecision or potential reversal

- Consistent patterns - possible trend continuation or reversal signals

Even without technical indicators, candlestick charts can help traders identify support and resistance levels, breakouts, reversals, trends, and entry/exit zones.

A note on candlestick patterns

Over time, traders noticed that certain candlestick formations tend to appear before price reversals or breakouts. These are known as candlestick patterns, and they’re often used to anticipate market behavior - especially turning points.

While no pattern is 100% reliable, some are considered strong signals when combined with other tools. For example:

- Hammer / Rising Hammer - May signal reversal at the bottom of a downtrend

- Shooting star / Falling Hammer - Potential top of an uptrend

- Three white soldiers / three black crows - Trend continuation indicators

- Spinning top - Market indecision that often precedes reversals

Many traders build their entire strategy around recognizing and reacting to these patterns. We cover these patterns - and many others - in dedicated articles that break down how each one works and how traders use them in real-world scenarios.

What candlesticks don’t show

Candlesticks are useful - but they don’t tell the whole story. For example:

- The exact sequence of price movements (e.g. whether the high or low came first)

- Detailed activity between open and close

- Price gaps in certain formats

On shorter timeframes, candlesticks can also create a lot of market noise - rapid changes that may not reflect a true trend. Zooming out to longer timeframes (e.g. 1-hour, 1-day) often gives a clearer view.

Heikin-Ashi: A smoother alternative

While standard “Japanese candlesticks” are the most common, another type called Heikin-Ashi offers a smoothed version of price action by averaging out data.

- Green Heikin-Ashi candles with no lower wicks = strong uptrend

- Red candles with no upper wicks = strong downtrend

Heikin-Ashi is great for identifying trends and reducing false signals - but it’s slower to react and doesn’t show precise prices, which makes it less useful for short-term entries.

Many traders use both styles together - standard candles for entry/exit precision, and Heikin-Ashi for overall trend direction.

Why candlesticks matter in crypto

Candlestick charts are especially useful in crypto because they are:

- Easy to read - The visual format makes it simple to see whether price moved up or down

- Easy to interpret - Each candle tells a clear story of buying or selling pressure

- Easy to spot trends - Patterns form quickly and repeat often, making it easier to identify momentum shifts

In fast-moving markets like crypto, where prices can change rapidly and technical signals matter, candlesticks offer a quick way to stay informed and react with confidence.

Whether you're tracking Bitcoin’s long-term trajectory or trading altcoins on shorter timeframes, learning to read candlestick charts gives you an edge.

Final thoughts

Candlestick charts give traders a visual way to understand price action - showing not just where price has been, but how it moved along the way. Learning to read them is a foundational skill in crypto trading.

Pair this knowledge with risk management, fundamental analysis, and consistent practice - and you’ll be in a much better position to make smarter trading decisions.

Explore Related Articles

This is the first article in our candlestick chart series. Ready to go deeper?

Explore each pattern and indicator in detail to better understand how traders spot trend shifts, momentum, and market reversals:

- Rising Bullish Hammer Candlestick Pattern Explained

- Shooting Star (Falling Hammer) Candlestick Pattern Explained

- Bullish Engulfing: A Signal That Buyers Are Taking Over

- Bearish Engulfing: A Signal That Sellers Are Taking Control

- Morning Star Pattern: A Signal That Buyers Are Stepping In

- Evening Star: A Signal That Sellers Are Stepping In

- Golden Cross: A Signal That Bullish Momentum Is Building

- Bearish (Death) Cross: A Signal That Momentum May Be Turning Against the Market

- Pi Cycle Top: A Signal That Bitcoin May Be Peaking

- What Is the MACD Indicator? A Guide to Moving Average Convergence Divergence in Crypto

- Relative Strength Index (RSI): Spotting Overbought and Oversold Markets

- Stochastic Oscillator: Measuring Momentum and Spotting Reversals

Get started by understanding the basics of cryptocurrency and explore decentralized finance (DeFi). Learn about Bitcoin, Ethereum, and altcoins. Also, discover how to buy and sell crypto.

Disclaimer

No Investment Advice

The information provided in this article is for educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Bitcoin.com does not recommend or endorse the buying, selling, or holding of any cryptocurrency, token, or financial instrument. You should not rely on the content of this article as a basis for any investment decision. Always do your own research and consult a licensed financial advisor before making any investment decisions.

Accuracy of Information

While we strive to ensure the accuracy and reliability of the information presented, Bitcoin.com makes no guarantees regarding the completeness, timeliness, or accuracy of any content. All information is provided “as is” and is subject to change without notice. You understand that you use any information available here at your own risk.

Related guides

Start from here →

What is a Decentralized Exchange (DEX)?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

What is a Decentralized Exchange (DEX)?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

What is a Centralized Exchange (CEX)?

Learn about CEXs, the differences between them and DEXs, and whether they’re safe to use.

What is a Centralized Exchange (CEX)?

Learn about CEXs, the differences between them and DEXs, and whether they’re safe to use.

How does crypto exchange work?

How safe is it to store your crypto on centralized exchanges?

How does crypto exchange work?

How safe is it to store your crypto on centralized exchanges?

Bitcoin Trading for Beginners

A comprehensive guide to Bitcoin trading for beginners, covering wallets, exchanges, market analysis, and risk management strategies.

Bitcoin Trading for Beginners

A comprehensive guide to Bitcoin trading for beginners, covering wallets, exchanges, market analysis, and risk management strategies.

Reading Bitcoin Charts for Beginners

A beginner's guide to understanding Bitcoin charts, covering candlestick patterns, technical indicators, market analysis, and risk management.

Reading Bitcoin Charts for Beginners

A beginner's guide to understanding Bitcoin charts, covering candlestick patterns, technical indicators, market analysis, and risk management.

Bull vs Bear Market Explained

Learn what defines bull and bear markets, how investor behavior shifts in each phase, and how Bitcoin historically moves through market cycles.

Bull vs Bear Market Explained

Learn what defines bull and bear markets, how investor behavior shifts in each phase, and how Bitcoin historically moves through market cycles.

Trading Analysis: Fundamental, Technical & Sentimental

Learn about fundamental, technical, and sentimental analysis for smarter trading decisions. Explore examples, tools, and how to combine these methods for a holistic market view.

Trading Analysis: Fundamental, Technical & Sentimental

Learn about fundamental, technical, and sentimental analysis for smarter trading decisions. Explore examples, tools, and how to combine these methods for a holistic market view.

STAY AHEAD IN CRYPTO

Stay ahead in crypto with our weekly newsletter delivering the insights that matter most

Weekly crypto news, curated for you

Actionable insights and educational tips

Updates on products fueling economic freedom

No spam. Unsubscribe anytime.

Start investing safely with the Bitcoin.com Wallet

Over wallets created so far

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely

© 2026 Saint Bitts LLC Bitcoin.com. All rights reserved