What is a DAO?

Last updated

Table of Contents

How do DAOs work?

A reasonably analogous way to think of a DAO is as a company. Companies are composed of people who follow rules. Those rules are ultimately enforced by the laws of the companies’ jurisdiction. DAO rules are enforced not by law, but by code in smart contracts.

Read more: What’s a smart contract?

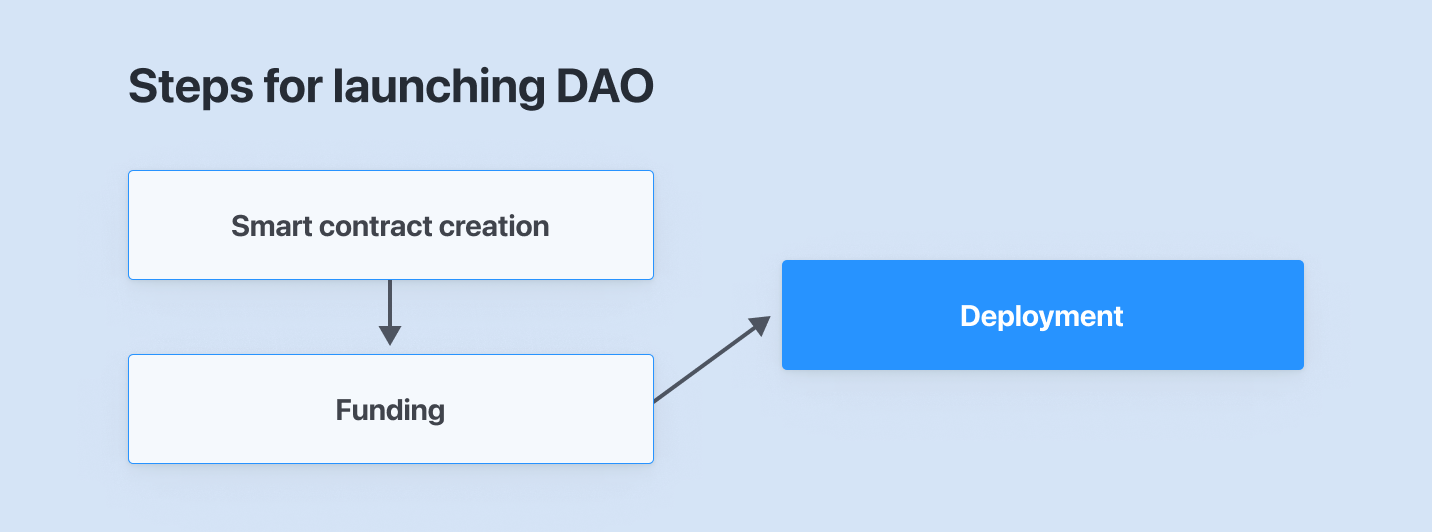

Starting a DAO usually follows three steps: write the smart contracts, acquire funding and establish stakeholders, and deploy the smart contracts on a blockchain.

In the first step, a core team of community members write all the rules that will govern the DAO. This includes: organizational hierarchy, proposal and voting process, funding mechanisms, and the extensibility of the DAO itself. The smart contracts need to be tested again and again for errors, edge cases, and overlooked details. When the team is satisfied, the core rules are deployed on a blockchain. The ruleset that makes the DAO fully autonomous are held back, as the core team still needs to steward the young organization. After all, there isn’t yet a way for people to join the DAO and become stakeholders.

In the second step, the core team attracts funds to the DAO. This might appear to be primarily a way to raise funds for the new organization, but actually it is most importantly a way to create stakeholders in preparation for a fully autonomous organization. Usually tokens are minted and sold to raise funds. The tokens give holders voting rights.

In the third step, the core team deploys the remainder of the rules in the smart contracts. Once this happens, the core team no longer can singularly control the DAO. From that point forward, all stakeholders decide what happens next. This third step can take quite some time to happen – years, even.

What are the advantages of DAOs?

DAOs bring the benefits of crypto to organizational structures: trustless, transparent, composable, decentralized.

In the increasingly internet-based world, DAOs can be a more efficient way to create organizations, especially organizations spread across the world and with large treasuries. There have been plenty of successful internet-based organizations, but once money, especially large sums of money is involved, those organizations rarely can remain internet first. They incorporate somewhere.

With DAOs there’s no need to wade through complicated multi-jurisdictional business incorporation paperwork. The people who have invested their money into a DAO do not necessarily need to trust the other people in the organization since treasury management is governed by transparent and auditable smart contracts.

DAOs benefit from the composability of crypto. The smart contracts to start DAOs are open for all to see. This means a new group can easily copy a successful DAO’s organization for their own purposes. Even better, a new group can take pieces from one project and pieces from another. Composability also means that DAOs can easily interact with other projects.

DAOs can take all forms of hierarchy. So far, most DAOs have favored a flat hierarchical structure. Unlike traditional corporate organizations, this has worked relatively well. Still, some DAOs are experimenting with introducing more vertical hierarchy. This kind of experimentation is healthy and overtime will benefit everyone in the space.

What are the disadvantages of DAOs?

DAOs are a new technology within the crypto industry, itself a nascent field! As such, there are risks associated with smart contracts. In fact, the very first DAO, simply called “The DAO," suffered a hack from a bug that drained over $60 million dollars worth of ETH.

Many DAOs start as online-only organizations, but after some time wish to pivot into more traditional companies. There are not strong legal frameworks in most countries governing DAOs. Also, any legal issues that may arise from a DAO can become very complicated, dealing with multiple jurisdictions.

Finally, many DAO hierarchy structures have impeded swift resolution of problems that in a faster acting organization would have been able to resolve. The aforementioned “The DAO" exploit was known, but before the organization could deploy a fix, an attacker exploited the weakness. The same exact situation has happened many times since then.

Related guides

Start from here →

What is DeFi?

Learn what makes decentralized finance (DeFi) apps work and how they compare to traditional financial products.

What is DeFi?

Learn what makes decentralized finance (DeFi) apps work and how they compare to traditional financial products.

What are NFTs?

Learn about NFTs, how they work, examples of prominent NFTs, and much more.

What are NFTs?

Learn about NFTs, how they work, examples of prominent NFTs, and much more.

What is a DEX?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

What is a DEX?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

DeFi use cases

Decentralized Finance (DeFi) is bringing access to financial products to everyone. In this article we examine some prominent use cases.

DeFi use cases

Decentralized Finance (DeFi) is bringing access to financial products to everyone. In this article we examine some prominent use cases.

DEX lingo

From AMM to yield farming, learn the key vocabulary you’ll encounter when trading on a DEX.

DEX lingo

From AMM to yield farming, learn the key vocabulary you’ll encounter when trading on a DEX.

What is liquidity?

Liquidity has several slightly different but interrelated meanings. For the purposes of crypto, liquidity most often refers to financial liquidity and market liquidity.

What is liquidity?

Liquidity has several slightly different but interrelated meanings. For the purposes of crypto, liquidity most often refers to financial liquidity and market liquidity.

What is APY?

APY stands for annual percentage yield. It is a way to calculate interest earned on an investment that includes the effects of compound interest.

What is APY?

APY stands for annual percentage yield. It is a way to calculate interest earned on an investment that includes the effects of compound interest.

STAY AHEAD IN CRYPTO

Stay ahead in crypto with our weekly newsletter delivering the insights that matter most

Weekly crypto news, curated for you

Actionable insights and educational tips

Updates on products fueling economic freedom

No spam. Unsubscribe anytime.

Start investing safely with the Bitcoin.com Wallet

Over wallets created so far

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely

© 2026 Saint Bitts LLC Bitcoin.com. All rights reserved