How to use a DEX

Last updated

This article covers how to swap between cryptoassets and how to look at DEX analytics with links to step-by-step instructions for the Verse DEX using the Bitcoin.com Wallet app.

Table of Contents

The basics of using a DEX

DEXs enable people to permissionlessly swap between cryptoassets. For example, on the Verse DEX a popular trading pair is VERSE-WETH. Unlike on centralized exchanges, anyone has the ability to make a trading pair or add liquidity to an existing pair. In fact, all DEX swaps are made possible by people adding liquidity to trading pair “pools," like the aforementioned VERSE-WETH pair.

DEXs provide a place to easily see important analytics about the DEX, such as total liquidity and volume, as well as a breakdown on liquidity and volume of the DEX’s trading pairs.

If you were unfamiliar with any terms used in this section, please refer to the below section called, “Key terms." For a more thorough look at DEXs, check out this article.

What you need in order to use a DEX

You will need three things to swap cryptoassets on a decentralized exchange:

- Digital wallet

- Cryptocurrency

- DEX site

Digital wallet: These wallets, also called crypto wallets or web3 wallets, hold cryptocurrencies and other digital assets. The best wallets are self-custodial like the Bitcoin.com Wallet app. Self-custody means you have full control over the contents of the wallet, whereas in custodial wallets a third party has ultimate control. Learn more about self-custody and its importance [here] (/get-started/custodial-non-custodial-bitcoin-wallets/).

Cryptocurrency: The wallet will need to contain cryptocurrency to pay for transaction fees as well as to swap. Transactions fees are used to pay for actions that make changes to a blockchain. They will be paid in the blockchain’s native currency. For example, ETH is used to pay for transaction fees on the Ethereum blockchain. To swap from one cryptoasset to another, you will of course need a cryptoasset to swap from. Learn how to buy your first cryptoasset in this article.

DEX site: It’s important to use a reputable decentralized exchange that also has a healthy amount of liquidity. The next section introduces just such an exchange.

Introduction to Verse DEX

The Verse DEX is a full-featured decentralized exchange. It is a key component of the Bitcoin.com/Verse ecosystem, providing anyone in the world with a secure way to permissionlessly swap cryptocurrencies without having to rely on third-party custodians. You can also earn yield by providing liquidity to the Verse DEX. More information about VERSE token is available at getverse.com.

Key terms

Liquidity - Liquidity is arguably the most important measurement of the health of any market, crypto or traditional. In an exchange, liquidity is a measure of how easily two assets can be exchanged without dramatic shifts in price of either assets. For example, imagine you swap 1 ETH for 1500 USDC and the next person swaps 1 ETH for 2000 USDC. The price on that exchange has changed dramatically after just one relatively small transaction. That exchange’s ETH-USDC pair would be considered to have poor liquidity.

Learn more about liquidity in this great primer.

Pool (liquidity pool) - A pool refers to a pool of funds for a trading pair (eg. VERSE-WETH) on a DEX. People who provide liquidity in a pool earn a share of the fees traded.

Liquidity is so important that DEXs often provide additional incentives for participating in liquidity pools. Without liquidity, a DEX cannot fulfill its main purpose, which is to facilitate swapping between cryptoassets.

Slippage - Slippage refers to the difference in price when an order is made. When a buyer or seller’s final sale price moves up or down more than the requested price, the price is said to “slip." On many DEXs, you can specify your slippage tolerance, or how much you are willing to allow the final price to change and still execute. It is not advisable to increase your slippage tolerance because the price you are quoted can change up to the slippage amount. For example, if 1 ETH is quoted at 1500 USDC but your slippage tolerance is 10%, you might end up paying 1650 USDC instead (an addition of 10%, or 150 USDC).

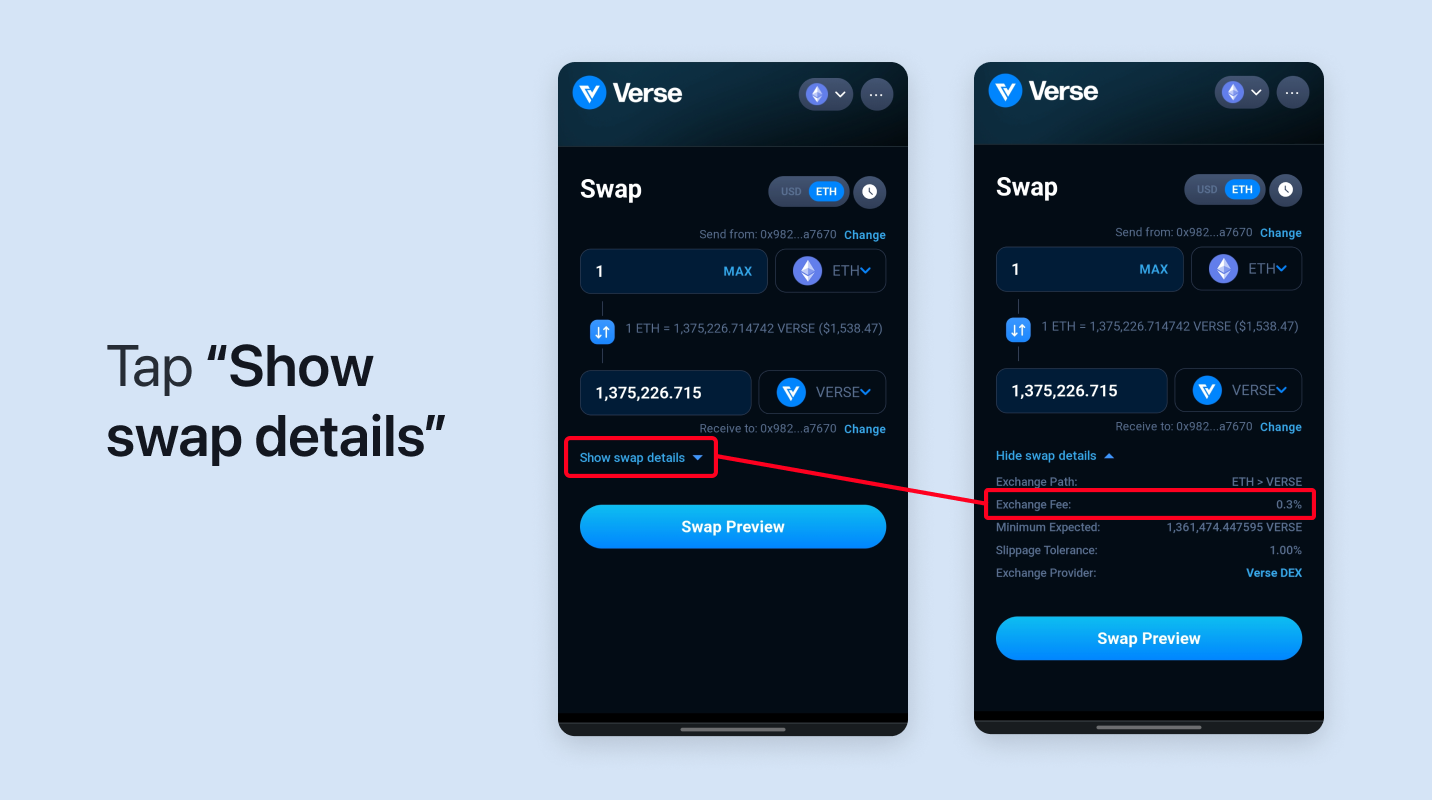

On the Verse DEX you can see the Slippage Tolerance by tapping the “Show swap details" text above the “Swap Preview" button.

Exchange path - There isn’t always a direct way, or a very liquid way to directly trade between two cryptoassets. Exchange paths, or routes as they’re sometimes called, find the most liquid, and therefore the least expensive way to swap between the assets you want. For example, let’s say you want to trade between ETH and SHIB. If there is no ETH-SHIB pair, or if the ETH-SHIB pair is not very liquid, the DEX will look for alternatives. The DEX might find that the ETH-VERSE and VERSE-SHIB pairs exist and have good liquidity. The DEX will automatically use this alternate path to facilitate the trade. In the above example, the exchange path would be ETH->VERSE->SHIB.

Exchange fee - A small percentage of every swap is paid to liquidity providers and the exchange for facilitating the trade. Verse DEX charges 0.3% of the trade volume per token swap. 83.3% of the fee is given to liquidity providers while the remaining 16.7% goes to the protocol.

On the Verse DEX you can see the Exchange Fee by tapping the “Show swap details" text.

How to swap

Swap is the main function of a DEX. The swap interface typically has a field to input the amount followed by a drop down menu to choose the cryptoasset. Under that is another input field and drop down menu. You swap from the top to the bottom.

To swap on a DEX, you will first connect your crypto wallet to the DEX. Then choose the cryptoassets you want to swap from and to, and the amount. Execute the transaction by pressing the “swap" button.

Unfortunately, DEXs make design choices that make this process easier or harder. The Verse DEX is designed to be easy even for beginners. For step-by-step instructions on how to swap using the Verse DEX, use this support article.

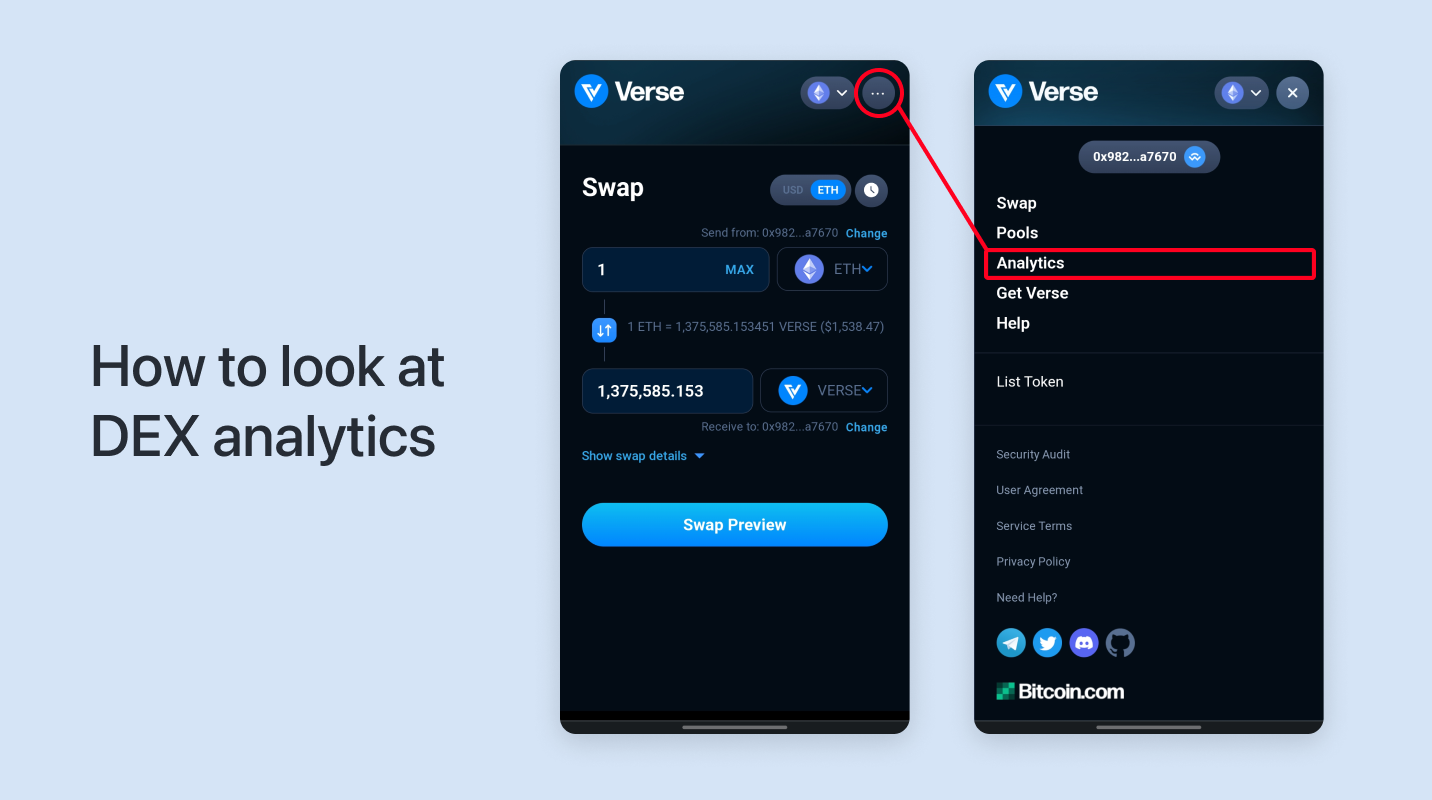

How to look at DEX analytics

The analytics section of a DEX shows important statistics such as trading pair liquidity, volume, and fees. Usually you can get extra information for a trading pair by clicking on it.

Here’s how it works on the Verse DEX:

- Tap the 3 dot (meatballs) menu button in the top right corner of the DApp, and tap “Analytics."

- This will take you to the Dashboard, which shows an overview of the Exchange’s liquidity, volume, top liquidity pairs, and top tokens. Scroll down to see all of these categories.

- You can get more detail on liquidity pairs and tokens by clicking on the Pair or Token name. For example, tapping on “VERSE-WETH" reveals information such as fees generated, number of transactions, and average trade size in the last 24 hours.

Related guides

Start from here →

What is a DEX?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

What is a DEX?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

What is DeFi?

Learn what makes decentralized finance (DeFi) apps work and how they compare to traditional financial products.

What is DeFi?

Learn what makes decentralized finance (DeFi) apps work and how they compare to traditional financial products.

DeFi use cases

Decentralized Finance (DeFi) is bringing access to financial products to everyone. In this article we examine some prominent use cases.

DeFi use cases

Decentralized Finance (DeFi) is bringing access to financial products to everyone. In this article we examine some prominent use cases.

DEX lingo

From AMM to yield farming, learn the key vocabulary you’ll encounter when trading on a DEX.

DEX lingo

From AMM to yield farming, learn the key vocabulary you’ll encounter when trading on a DEX.

What are crypto derivatives?

Derivatives like perpetual futures and options are widely used in crypto. Learn all about them.

What are crypto derivatives?

Derivatives like perpetual futures and options are widely used in crypto. Learn all about them.

What are prediction markets?

Find out about prediction markets, including how they work and what they are used for.

What are prediction markets?

Find out about prediction markets, including how they work and what they are used for.

Dollar-cost averaging

Learn how to protect yourself from big losses with this simple but powerful investment strategy.

Dollar-cost averaging

Learn how to protect yourself from big losses with this simple but powerful investment strategy.

What is APY?

APY stands for annual percentage yield. It is a way to calculate interest earned on an investment that includes the effects of compound interest.

What is APY?

APY stands for annual percentage yield. It is a way to calculate interest earned on an investment that includes the effects of compound interest.

What is liquidity?

Liquidity has several slightly different but interrelated meanings. For the purposes of crypto, liquidity most often refers to financial liquidity and market liquidity.

What is liquidity?

Liquidity has several slightly different but interrelated meanings. For the purposes of crypto, liquidity most often refers to financial liquidity and market liquidity.

What is a token sale?

Token sales are an important part of the crypto ecosystem. Learn their ins and outs.

What is a token sale?

Token sales are an important part of the crypto ecosystem. Learn their ins and outs.

STAY AHEAD IN CRYPTO

Stay ahead in crypto with our weekly newsletter delivering the insights that matter most

Weekly crypto news, curated for you

Actionable insights and educational tips

Updates on products fueling economic freedom

No spam. Unsubscribe anytime.

Start investing safely with the Bitcoin.com Wallet

Over wallets created so far

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely

© 2026 Saint Bitts LLC Bitcoin.com. All rights reserved