Intercambios

- Mejores Intercambios de CriptomonedasPlataformas de Trading AlgorítmicoIntercambios sin KYCBots de arbitrajeAuto DCAComercio AutomatizadoOpciones BinariasIntercambios centralizadosTrading de contratosCopy TradingComercio de Índices de CriptomonedasIntercambios de Cripto a FiatCorredores de CriptomonedasOperaciones diariasIntercambios DescentralizadosCuentas de Trading de DemostraciónIntercambios de DerivadosComercio de Inversión DualIntercambios para principiantesComercio de FuturosComercio de cuadrículaIntercambios híbridosPlataformas de PréstamosTrading con ApalancamientoPools de liquidezOperación en vivoIntercambios con las Tarifas más BajasComercio con margenIntercambios de Creación de MercadoOperaciones con OpcionesIntercambios de Criptomonedas P2PIntercambios Compatibles con PayPalNegociación de Futuros PerpetuosCompras recurrentesIntercambios más segurosCuentas de ahorroIntercambios de venta en cortoIntercambios de Recompensas de StakingIntercambios de intercambioPlataformas de intercambioComercio de acciones tokenizadasComercio sin comisionesCripto OTCComercio InstitucionalBitcoin OTCGuías de Bitcoin OTCBots de trading de BitcoinAplicaciones de CriptomonedasAplicaciones de Comercio de CriptomonedasPlataformas de Trading de CriptomonedasPlataformas de comercio de criptomonedas australianasIntercambios para BitcoinLugares para comprar criptomonedasIntercambios de Bitcoin en EE. UU.Estrategias de negociación de BitcoinComercioMejores Prácticas de DEXMejores Prácticas de DeFiDescripción general de DEXTutoriales DEX

Carteras

- Mejores Carteras de CriptomonedasCarteras de autocustodiaCarteras de CustodiaCarteras de hardwareCarteras Multi-SigCarteras móvilesCarteras de EscritorioCarteras de Extensión del NavegadorCarteras LightningCarteras DeFi de BitcoinCarteras de papelCarteras de BitcoinCarteras Seguras de BitcoinCarteras de EthereumCarteras de SolanaCarteras PolkadotCarteras BNBCarteras de LitecoinCarteras RippleCarteras de CardanoCarteras AvalancheCarteras de TezosCarteras NFTCarteras DeFiCarteras de StakingCarteras de ComercioCarteras de juegoCarteras de PrivacidadHODL WalletsCarteras de RemesasCarteras EmpresarialesCarteras MulticadenaServicios de billeteraOpciones de Respaldo de BilleteraCarteras SegurasConsejos de seguridad para la billeteraGuía de configuración de billeteraDescargas de billetera

Casinos

- Mejores casinos de criptomonedas y BitcoinCasinos de AltcoinCasinos de cartasCasinos de criptomonedasCasinos de ETHGuías: CasinosGuías: Estrategia de BlackjackGuías: Cómo jugar al BlackjackGuías: Cómo Jugar al PókerGuías: Cómo Jugar a la RuletaGuías: Estrategia de PókerGuías: Estrategia de la ruletaMejores CasinosBingoBots de casinoSin KYCCasinos de ArbitrumCasinos AvalancheBaccaratCasinos BaseCasinos BNBCasinos BCHCasinos de BitcoinVeintiunoBonos de casinoCasinos de CardanoJuegos de ClústerJuegos de Bote CósmicoCrapsChoqueDAI CasinosCasinos descentralizadosCasinos DeFiDadosCasinos de DiscordCasinos de DogecoinGotas y GananciasTragamonedas egipciasBonos de ETHETH Crupier en VivoBonos sin depósito de ETHRuleta ETHETH SlotsGiros GratisMáquinas Tragaperras GalácticasConcursos televisivosApostadores de Alto NivelCasinos de alta volatilidadJuegos de Casino de TerrorRetiro instantáneoBoteKenoCasinos de LitecoinCrupier en vivoCasinos de MetaMaskCasinos del MetaversoMinasCasinos de Depósito MínimoCasinos multijugadorNuevos CasinosCasinos NFTBonos sin depósitoTragamonedas de Mitología NórdicaCasinos de TrumpOptimisim CasinosTragamonedas PirataCasinos de PolygonCasinos enfocados en la privacidadBote ProgresivoDemostrablemente JustoRespinsRuletaPagos DispersosTarjetas Rasca y GanaCasinos de Shiba InuSic-BoTragamonedasCasinos socialesCasinos de SolanaCasinos de StablecoinCasinos de SorteosTON CasinosToshi CasinosTragamonedas de Búsqueda del TesoroTRX CasinosCasinos de USDCCasinos TetherVerse CasinosVideo PókerJuegos de Casino VikingosVIPRuedaCasinos RipplePachinkoLoteríaMeme CasinosCasinos móvilesCasinos en líneaPlinkoPókerGuías: Preguntas frecuentes sobre pókerGuías: Legalidad del pókerGuías: Promociones de PókerGuías: Reseñas de Salas de PókerGuías: Torneos de PókerJuegos de MesaCasinos de TelegramCasinos Web3Tragamonedas MegawaysLibro de tragamonedasJuega junto con CryptoConcursos DiariosSorteos SemanalesComprar juegos de bola extraTragamonedas de Mantener y Ganar

Casas de apuestas deportivas

- Mejores Casas de Apuestas Deportivas con BitcoinFútbolFútbol americanoSin KYCAbierto de Australia de TenisBádmintonBéisbolBaloncestoIntercambios de apuestasBonificacionesBoxeoBundesligaAjedrezBaloncesto universitarioCríquetCampeones de la ICCLiga Premier IndiaCiclismoDardosPremier League inglesaEsportsCall of DutyCSGODOTA-2FIFALOLStarcraftValorantWorld of WarcraftCopa Mundial de la FIFAApuestas de Hockey sobre HieloDraft de Entrada de la NHL 2025Campeonato Mundial de Hockey sobre Hielo 2025Fórmula 1Abierto de Francia de TenisTenis de Grand SlamCarreras de galgosBalonmanoHockeyCarreras de caballosDerby de KentuckyLa LigaApuestas en vivoLocura de marzoArtes Marciales MixtasDeportes de motorNascarDraft de la NBADraft de la NFLOlimpiadasPGAPolíticaPolítica (Trump)Política (Kamala)Política de EE. UU.RugbySerie ASnookerCarreras de coches de serieSuper BowlTenis de mesaUFCNoche de Pelea de UFCArriba vs AbajoAbierto de Estados Unidos de TenisVoleibolWimbledonDeportes de inviernoGolfFútbolTenis

Tarjetas

- Mejores Tarjetas CriptoTarjetas de Criptomonedas Sin KYCTarjetas de Reembolso de CriptomonedasTarjetas de Crédito CriptoTarjetas CriptoTarjetas de débito de criptomonedasTarjetas de regalo de criptomonedasTarjetas Mastercard de CriptomonedasTarjetas SolanaTarjetas prepago de criptomonedasTarjetas de Recompensas CriptoTarjetas Virtuales de CriptomonedasTarjetas Visa de CriptomonedasTarjetas Web3

Tipos de Intercambio

Plataformas de negociación

Reseñas Inicio

¿Qué es la gestión de criptoactivos?

En su sentido más básico, la gestión de activos se refiere a cómo una persona posee e invierte sus activos. En las finanzas tradicionales, la gestión de activos se utiliza con mayor frecuencia para describir a terceros que gestionan activos en nombre de otros. La gestión de criptoactivos incluye tanto las tenencias personales como los terceros que poseen e invierten en tu nombre.

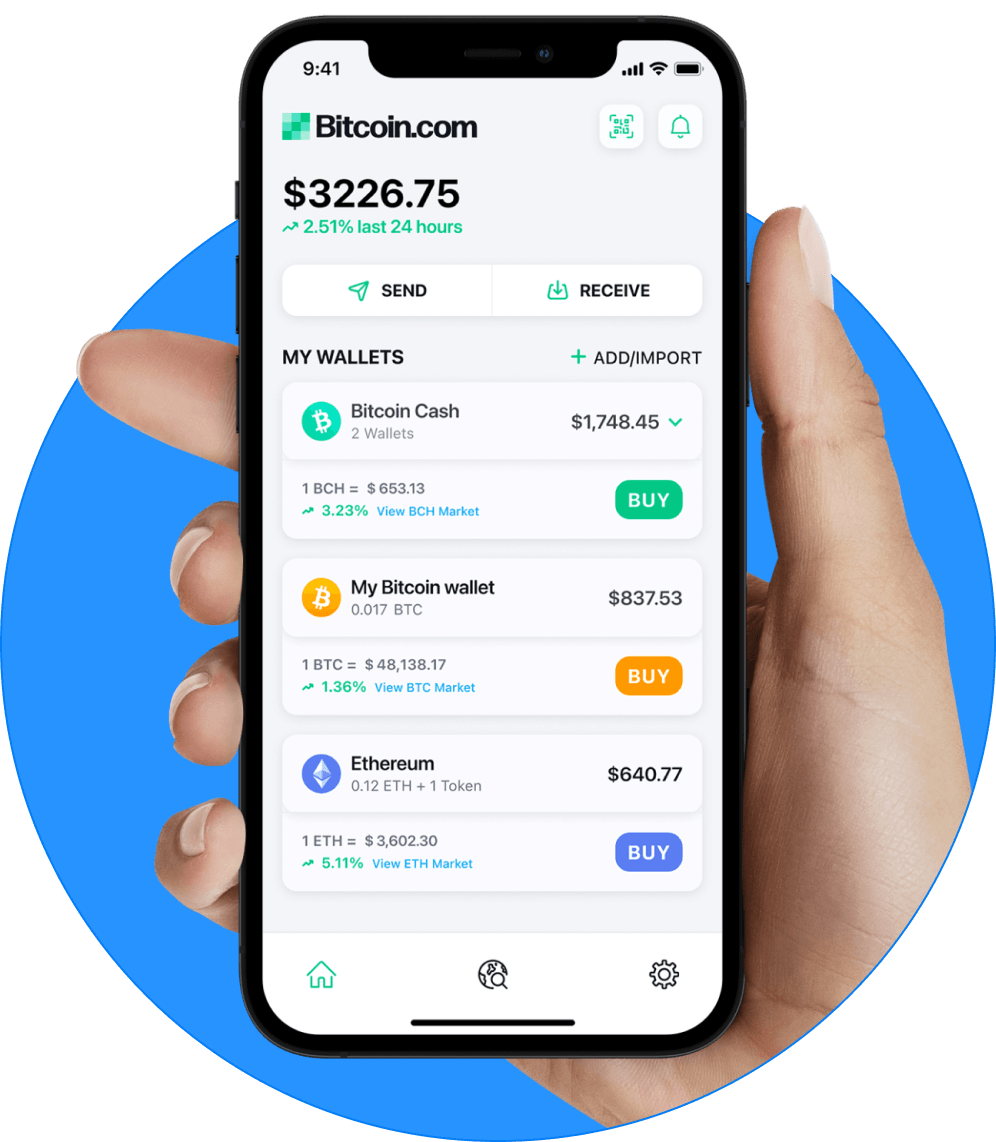

Utilice la aplicación Bitcoin.com Wallet de cadena múltiple, confiada por millones para comprar, vender, intercambiar y gestionar de manera segura y fácil bitcoin y las criptomonedas más populares.

Indice de Contenidos

Guías relacionadas

Empezar desde aqui →

Aprende los conceptos básicos de las criptomonedas

¿Eres nuevo en las criptomonedas? Obtén una introducción simple y descubre por qué las criptos son importantes.

Lee este artículo →

Aprende los conceptos básicos de las criptomonedas

¿Eres nuevo en las criptomonedas? Obtén una introducción simple y descubre por qué las criptos son importantes.

Bitcoin.com en tu bandeja de entrada

Un resumen semanal de las noticias importantes, además de recursos educativos y actualizaciones de productos y servicios que promueven la libertad económica

Comienza a invertir de forma segura a través del monedero de Bitcoin.com

Más de de carteras creadas

Todo lo que necesitas para comprar, vender, operar e invertir en bitcóin y otras criptomonedas de forma segura

Cree al suya ahora