- Mejores Intercambios de CriptomonedasPlataformas de Trading AlgorítmicoIntercambios sin KYCBots de arbitrajeAuto DCAComercio AutomatizadoOpciones BinariasIntercambios centralizadosTrading de contratosCopy TradingComercio de Índices de CriptomonedasIntercambios de Cripto a FiatCorredores de CriptomonedasOperaciones diariasIntercambios DescentralizadosCuentas de Trading de DemostraciónIntercambios de DerivadosComercio de Inversión DualIntercambios para principiantesComercio de FuturosComercio de cuadrículaIntercambios híbridosPlataformas de PréstamosTrading con ApalancamientoPools de liquidezOperación en vivoIntercambios con las Tarifas más BajasComercio con margenIntercambios de Creación de MercadoOperaciones con OpcionesIntercambios de Criptomonedas P2PIntercambios Compatibles con PayPalNegociación de Futuros PerpetuosCompras recurrentesIntercambios más segurosCuentas de ahorroIntercambios de venta en cortoIntercambios de Recompensas de StakingIntercambios de intercambioPlataformas de intercambioComercio de acciones tokenizadasComercio sin comisionesCripto OTCComercio InstitucionalBitcoin OTCGuías de Bitcoin OTCBots de trading de BitcoinAplicaciones de CriptomonedasAplicaciones de Comercio de CriptomonedasPlataformas de Trading de CriptomonedasPlataformas de comercio de criptomonedas australianasIntercambios para BitcoinLugares para comprar criptomonedasIntercambios de Bitcoin en EE. UU.Estrategias de negociación de BitcoinComercioMejores Prácticas de DEXMejores Prácticas de DeFiDescripción general de DEXTutoriales DEX

- Mejores Carteras de CriptomonedasCarteras de autocustodiaCarteras de CustodiaCarteras de hardwareCarteras Multi-SigCarteras móvilesCarteras de EscritorioCarteras de Extensión del NavegadorCarteras LightningCarteras DeFi de BitcoinCarteras de papelCarteras de BitcoinCarteras Seguras de BitcoinCarteras de EthereumCarteras de SolanaCarteras PolkadotCarteras BNBCarteras de LitecoinCarteras RippleCarteras de CardanoCarteras AvalancheCarteras de TezosCarteras NFTCarteras DeFiCarteras de StakingCarteras de ComercioCarteras de juegoCarteras de PrivacidadHODL WalletsCarteras de RemesasCarteras EmpresarialesCarteras MulticadenaServicios de billeteraOpciones de Respaldo de BilleteraCarteras SegurasConsejos de seguridad para la billeteraGuía de configuración de billeteraDescargas de billetera

- Mejores casinos de criptomonedas y BitcoinCasinos de AltcoinCasinos de cartasCasinos de criptomonedasCasinos de ETHGuías: CasinosGuías: Estrategia de BlackjackGuías: Cómo jugar al BlackjackGuías: Cómo Jugar al PókerGuías: Cómo Jugar a la RuletaGuías: Estrategia de PókerGuías: Estrategia de la ruletaMejores CasinosBingoBots de casinoSin KYCCasinos de ArbitrumCasinos AvalancheBaccaratCasinos BaseCasinos BNBCasinos BCHCasinos de BitcoinVeintiunoBonos de casinoCasinos de CardanoJuegos de ClústerJuegos de Bote CósmicoCrapsChoqueDAI CasinosCasinos descentralizadosCasinos DeFiDadosCasinos de DiscordCasinos de DogecoinGotas y GananciasTragamonedas egipciasBonos de ETHETH Crupier en VivoBonos sin depósito de ETHRuleta ETHETH SlotsGiros GratisMáquinas Tragaperras GalácticasConcursos televisivosApostadores de Alto NivelCasinos de alta volatilidadJuegos de Casino de TerrorRetiro instantáneoBoteKenoCasinos de LitecoinCrupier en vivoCasinos de MetaMaskCasinos del MetaversoMinasCasinos de Depósito MínimoCasinos multijugadorNuevos CasinosCasinos NFTBonos sin depósitoTragamonedas de Mitología NórdicaCasinos de TrumpOptimisim CasinosTragamonedas PirataCasinos de PolygonCasinos enfocados en la privacidadBote ProgresivoDemostrablemente JustoRespinsRuletaPagos DispersosTarjetas Rasca y GanaCasinos de Shiba InuSic-BoTragamonedasCasinos socialesCasinos de SolanaCasinos de StablecoinCasinos de SorteosTON CasinosToshi CasinosTragamonedas de Búsqueda del TesoroTRX CasinosCasinos de USDCCasinos TetherVerse CasinosVideo PókerJuegos de Casino VikingosVIPRuedaCasinos RipplePachinkoLoteríaMeme CasinosCasinos móvilesCasinos en líneaPlinkoPókerGuías: Preguntas frecuentes sobre pókerGuías: Legalidad del pókerGuías: Promociones de PókerGuías: Reseñas de Salas de PókerGuías: Torneos de PókerJuegos de MesaCasinos de TelegramCasinos Web3Tragamonedas MegawaysLibro de tragamonedasJuega junto con CryptoConcursos DiariosSorteos SemanalesComprar juegos de bola extraTragamonedas de Mantener y Ganar

- Mejores Casas de Apuestas Deportivas con BitcoinFútbolFútbol americanoSin KYCAbierto de Australia de TenisBádmintonBéisbolBaloncestoIntercambios de apuestasBonificacionesBoxeoBundesligaAjedrezBaloncesto universitarioCríquetCampeones de la ICCLiga Premier IndiaCiclismoDardosPremier League inglesaEsportsCall of DutyCSGODOTA-2FIFALOLStarcraftValorantWorld of WarcraftCopa Mundial de la FIFAApuestas de Hockey sobre HieloDraft de Entrada de la NHL 2025Campeonato Mundial de Hockey sobre Hielo 2025Fórmula 1Abierto de Francia de TenisTenis de Grand SlamCarreras de galgosBalonmanoHockeyCarreras de caballosDerby de KentuckyLa LigaApuestas en vivoLocura de marzoArtes Marciales MixtasDeportes de motorNascarDraft de la NBADraft de la NFLOlimpiadasPGAPolíticaPolítica (Trump)Política (Kamala)Política de EE. UU.RugbySerie ASnookerCarreras de coches de serieSuper BowlTenis de mesaUFCNoche de Pelea de UFCArriba vs AbajoAbierto de Estados Unidos de TenisVoleibolWimbledonDeportes de inviernoGolfFútbolTenis

- Mejores Tarjetas CriptoTarjetas de Criptomonedas Sin KYCTarjetas de Reembolso de CriptomonedasTarjetas de Crédito CriptoTarjetas CriptoTarjetas de débito de criptomonedasTarjetas de regalo de criptomonedasTarjetas Mastercard de CriptomonedasTarjetas SolanaTarjetas prepago de criptomonedasTarjetas de Recompensas CriptoTarjetas Virtuales de CriptomonedasTarjetas Visa de CriptomonedasTarjetas Web3

Tipos de Intercambio

Plataformas de negociación

¿Qué es Avalanche?

Guías relacionadas

Empezar desde aqui →

¿Cómo compro criptomonedas?

Aprende cómo obtener tu primera criptomoneda en minutos.

Lee este artículo →

¿Cómo compro criptomonedas?

Aprende cómo obtener tu primera criptomoneda en minutos.

¿Cómo vendo criptomonedas?

Aprenda cómo vender criptomonedas por moneda local de manera segura.

Lee este artículo →

¿Cómo vendo criptomonedas?

Aprenda cómo vender criptomonedas por moneda local de manera segura.

¿Cómo envío criptomonedas?

Enviar criptomonedas es tan fácil como elegir la cantidad a enviar y decidir a dónde va.

Lee este artículo →

¿Cómo envío criptomonedas?

Enviar criptomonedas es tan fácil como elegir la cantidad a enviar y decidir a dónde va.

¿Cómo creo una billetera de criptomonedas?

Aprende a crear una billetera de criptomonedas de manera rápida y sencilla. Entiende los diferentes tipos de billeteras y sus respectivos pros y contras.

Lee este artículo →

¿Cómo creo una billetera de criptomonedas?

Aprende a crear una billetera de criptomonedas de manera rápida y sencilla. Entiende los diferentes tipos de billeteras y sus respectivos pros y contras.

¿Qué es Bitcoin?

Obtén una introducción sencilla a Bitcoin y por qué es importante.

Lee este artículo →

¿Qué es Bitcoin?

Obtén una introducción sencilla a Bitcoin y por qué es importante.

¿Qué es Ethereum?

Comprender las características clave de Ethereum.

¿Qué son los NFT?

Aprende sobre los NFTs, cómo funcionan, ejemplos de NFTs destacados y mucho más.

Lee este artículo →

¿Qué son los NFT?

Aprende sobre los NFTs, cómo funcionan, ejemplos de NFTs destacados y mucho más.

¿Qué es DeFi?

Aprende qué hace que las aplicaciones de finanzas descentralizadas (DeFi) funcionen y cómo se comparan con los productos financieros tradicionales.

Lee este artículo →

¿Qué es DeFi?

Aprende qué hace que las aplicaciones de finanzas descentralizadas (DeFi) funcionen y cómo se comparan con los productos financieros tradicionales.

¿Qué es una dApp?

Descubre qué son las dApps, cómo funcionan, sus ventajas y desventajas, y más.

Lee este artículo →

¿Qué es una dApp?

Descubre qué son las dApps, cómo funcionan, sus ventajas y desventajas, y más.

¿Qué es un DEX?

Un intercambio descentralizado (DEX) es un tipo de intercambio que se especializa en transacciones entre pares de criptomonedas y activos digitales. A diferencia de los intercambios centralizados (CEX), los DEX no requieren un tercero de confianza, o intermediario, para facilitar el intercambio de criptoactivos.

Lee este artículo →

¿Qué es un DEX?

Un intercambio descentralizado (DEX) es un tipo de intercambio que se especializa en transacciones entre pares de criptomonedas y activos digitales. A diferencia de los intercambios centralizados (CEX), los DEX no requieren un tercero de confianza, o intermediario, para facilitar el intercambio de criptoactivos.

Bitcoin.com en tu bandeja de entrada

Un resumen semanal de las noticias importantes, además de recursos educativos y actualizaciones de productos y servicios que promueven la libertad económica

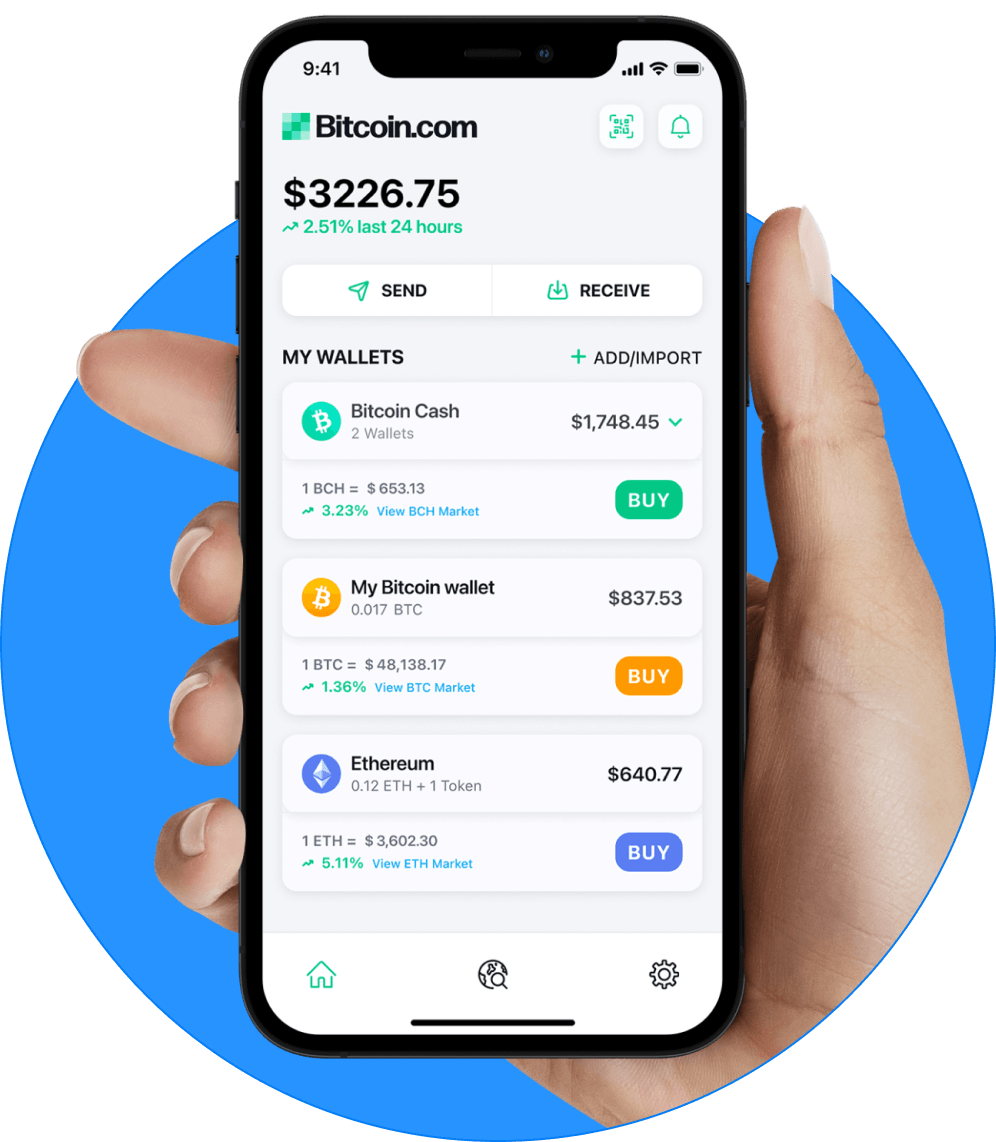

Comienza a invertir de forma segura a través del monedero de Bitcoin.com

Todo lo que necesitas para comprar, vender, operar e invertir en bitcóin y otras criptomonedas de forma segura