交易所

- 最佳加密货币交易所算法交易平台无KYC交易所套利机器人自动 DCA自动交易二元期权中心化交易所合约交易复制交易加密指数交易加密货币到法定货币的交易所加密经纪商日间交易去中心化交易所模拟交易账户衍生品交易所双重投资交易初学者交易所期货交易网格交易混合交易所借贷平台杠杆交易流动性池实时交易最低费用交易所保证金交易做市交易所期权交易P2P加密货币交易所支持PayPal的交易所永续期货交易定期购买最安全的交易所储蓄账户做空交易所质押奖励交易所交换所交换平台代币化股票交易零费用交易加密场外交易机构交易比特币场外交易比特币场外交易指南比特币交易机器人加密应用程序加密货币交易应用程序加密货币交易平台澳大利亚加密货币交易平台比特币交易所购买加密货币的地方美国比特币交易所比特币交易策略交易DEX最佳实践去中心化金融最佳实践DEX概述DEX教程

赌场

- 最佳加密货币和比特币赌场山寨币赌场卡片赌场加密货币赌场ETH 赌场指南:赌场指南:二十一点策略指南:如何玩二十一点指南:如何玩扑克指南:如何玩轮盘赌指南:扑克策略指南:轮盘策略顶级赌场宾果赌场机器人无需KYCArbitrum赌场雪崩赌场百家乐基础赌场BNB 赌场BCH赌场比特币赌场二十一点赌场奖金卡尔达诺赌场集群游戏宇宙大奖赛游戏骰子游戏崩溃DAI 赌场去中心化赌场去中心化金融赌场骰子Discord赌场狗狗币赌场掉落和胜利埃及老虎机ETH 奖金ETH真人荷官ETH 无存款奖金ETH轮盘ETH 老虎机免费旋转银河老虎机游戏节目高额玩家高波动性赌场恐怖赌场游戏即时提款头奖基诺莱特币赌场真人荷官MetaMask赌场元宇宙赌场矿井最低存款赌场多人赌场最新赌场NFT 赌场无存款奖金北欧神话老虎机特朗普赌场乐观赌场海盗老虎机多边形赌场注重隐私的赌场累积奖金可证明的公平重转轮盘赌分散支付刮刮卡柴犬赌场骰宝插槽社交赌场索拉纳赌场稳定币赌场抽奖娱乐场TON赌场Toshi 赌场寻宝老虎机TRX 赌场USDC 赌场泰达赌场诗赌场视频扑克维京赌场游戏贵宾轮子瑞波赌场弹珠机彩票迷因赌场移动赌场在线赌场普林科扑克指南:扑克常见问题解答指南:扑克合法性指南:扑克促销活动指南:扑克室评论指南:扑克锦标赛桌游电报赌场Web3赌场Megaways 老虎机老虎机书与加密货币一起玩每日竞赛每周抽奖活动购买额外的滚球游戏持有并赢得老虎机

体育博彩

- 最佳比特币体育博彩网站足球美式足球无需KYC澳大利亚网球公开赛羽毛球棒球篮球博彩交易所奖金拳击德甲国际象棋大学篮球板球ICC 冠军印度超级联赛骑行飞镖英格兰超级联赛电子竞技使命召唤CSGODOTA-2国际足联哈哈星际争霸无畏契约魔兽世界国际足联世界杯冰球投注2025年NHL选秀大会2025年冰球世界锦标赛一级方程式法国网球公开赛大满贯网球灰狗赛跑手球曲棍球赛马肯塔基赛马会西甲现场投注三月疯狂将以下英文文本翻译为中文:MMA赛车运动纳斯卡NBA选秀NFL选秀奥运会PGA政治政治(特朗普)政治 (卡玛拉)美国政治橄榄球意甲斯诺克赛车比赛超级碗乒乓球UFCUFC格斗之夜上与下美国网球公开赛排球温布尔登冬季运动高尔夫足球网球

YFI是什么?

Yearn Finance 是一个为去中心化金融(DeFi)投资者提供的聚合服务。它利用自动化技术帮助投资者最大化收益耕作的利润。该服务于2020年2月推出,前身为 iEarn,随着新产品的推出和内部代币 YFI 的发布,经历了巨大的增长。Yearn Finance 的目标是简化不断扩展的 DeFi 领域,以便于那些对技术不太了解或希望以比专业交易者更低投入方式参与的投资者。Yearn Finance 运行在以太坊和 Fantom 区块链上。

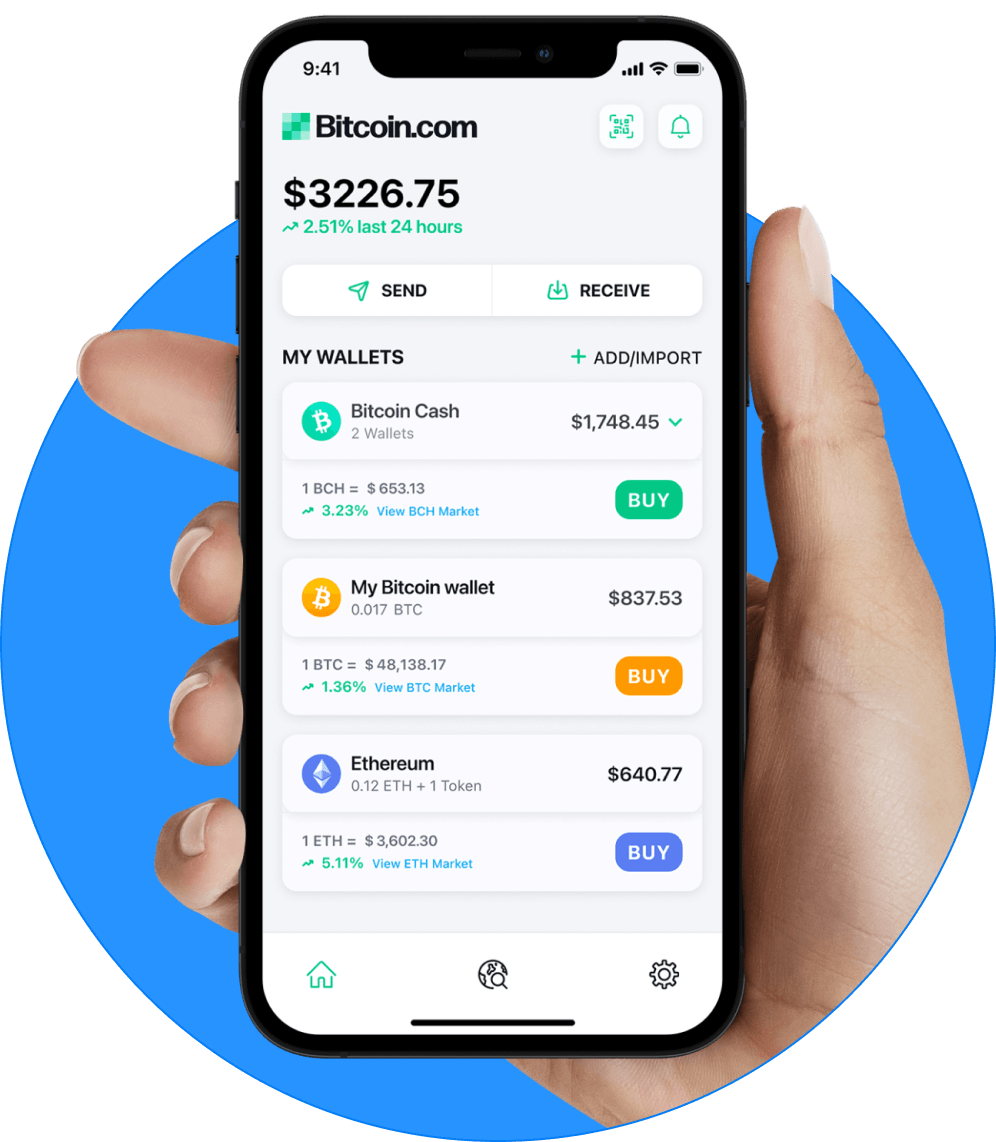

使用受数百万人信赖的多链Bitcoin.com Wallet 应用,安全且轻松地发送、接收、购买、出售、交易、使用和管理比特币、YIF 及最受欢迎的加密货币。

你收件箱中的 Bitcoin.com

每周的重要新闻提要,加上为经济自由提供支持的教育资源和产品及服务更新