- Лучшие криптовалютные биржиПлатформы алгоритмической торговлиБиржи без KYCАрбитражные ботыАвто DCAАвтоматизированная торговляБинарные опционыЦентрализованные биржиТорговля контрактамиКопи-трейдингТорговля криптоиндексамиКрипто-фиатные обменыКрипто брокерыДневная торговляДецентрализованные биржиДемо-счета для торговлиБиржевые деривативыТорговля двойными инвестициямиНачинающие биржиТорговля фьючерсамиТорговля по сеткеГибридные биржиПлатформы кредитованияТорговля с использованием заемных средствПулы ликвидностиЖивая торговляБиржи с самыми низкими комиссиямиМаржинальная торговляБиржи маркетмейкингаТорговля опционамиP2P криптообменыПоддерживаемые биржи PayPalТорговля бессрочными фьючерсамиПовторяющиеся покупкиСамые безопасные биржиСберегательные счетаШортинг биржБиржи вознаграждений за стекингБиржевой обменПоменять платформыТокенизированная торговля акциямиТорговля без комиссииКрипто OTCИнституциональная торговляБиткойн внебиржевойРуководства по внебиржевым операциям с биткоиномБоты для торговли биткоинамиКрипто-приложенияПриложения для криптотрейдингаПлатформы для криптотрейдингаАвстралийские платформы для торговли криптовалютойОбменники для биткоинаМеста для покупки криптовалютыБиткойн-биржи СШАСтратегии торговли биткоиномТорговляЛучшие практики DEXЛучшие практики DeFiОбзор DEXУчебные пособия по DEX

- Лучшие криптокошелькиКошельки с самостоятельным хранениемКастодиальные кошелькиАппаратные кошелькиМультиподписные кошелькиМобильные кошелькиНастольные кошелькиРасширения браузера для кошельковМолниеносные кошелькиDeFi Bitcoin кошелькиБумажные кошелькиБиткойн-кошелькиБезопасные биткоин-кошелькиКошельки EthereumКошельки SolanaКошельки PolkadotКошельки BNBКошельки LitecoinКошельки RippleКошельки CardanoКошельки AvalancheКошельки TezosКошельки NFTКошельки DeFiКошельки для стейкингаТорговые кошелькиИгровые кошелькиКошельки конфиденциальностиHODL кошелькиКошельки для переводовКорпоративные кошелькиМультицепные кошелькиУслуги кошелькаВарианты резервного копирования кошелькаБезопасные кошелькиСоветы по безопасности кошелькаРуководство по настройке кошелькаЗагрузки кошелька

- Лучшие крипто и биткоин казиноАльткоин КазиноКартовые казиноКрипто-казиноETH КазиноРуководства: КазиноРуководства: Стратегия блэкджекаРуководства: Как играть в БлэкджекРуководства: Как играть в покерРуководства: Как играть в рулеткуРуководства: Стратегия покера�Руководства: Стратегия РулеткиЛучшие казиноБингоКазино ботыБез KYCКазино ArbitrumЛавина КазиноБаккараБазовые казиноКазино BNBКазино BCHБиткойн казиноБлэкджекБонусы казиноКазино на КарданоКластерные пьесыКосмический Джекпот ИгрыКостиКрушениеDAI КазиноДецентрализованные казиноДеФи КазиноКубикКазино DiscordКазино DogecoinДропы и выигрышиЕгипетские слотыБонусы ETHETH Живой ДилерБонусы без депозита ETHETH РулеткаETH СлотыБесплатные вращенияГалактические игровые автоматыТелевизионные викториныКрупные игрокиКазино с высокой волатильностьюУжасные казино-игрыМгновенный выводДжекпотКеноКазино с ЛайткоинЖивой дилерКазино MetaMaskКазино МетавселеннойШахтыКазино с минимальным депозитомМногопользовательские казиноНовейшие казиноКазино с NFTБонусы без депозитаСлоты на тему скандинавской мифологииТрамп КазиноОптимизм КазиноПиратские слотыКазино PolygonКазино с акцентом на конфиденциальностьПрогрессивный джекпотДоказуемо честноПовторные спиныРулеткаРазброс выигрышейСкретч-картыКазино Шиба-ИнуСик-БоСлотыСоциальные казиноКазино SolanaКазино с использованием стейблкоиновКазино с лотереямиTON КазиноТоши КазиноСлоты "Охота за сокровищами"TRX КазиноКазино с USDCТезер КазиноВершина КазиноВидеопокерИгры казино ВикингВИПКолесоРипл КазиноПатинкоЛотереяМемные казиноМобильные казиноОнлайн-казиноПлинкоПокерРуководства: Часто задаваемые вопросы о покереРуководства: Законность покераРуководства: Покерные промоакцииРуководства: Обзоры покерных комнатРуководства: Покерные турнирыНастольные игрыКазино в ТелеграмеКазино Web3Megaways слотыКнига игровых автоматовИграйте вместе с криптовалютойЕжедневные конкурсыЕженедельные розыгрышиКупите дополнительные игры с мячомСлоты Hold and Win

- Лучшие букмекерские конторы для ставок в биткоинахФутболАмериканский футболБез KYCОткрытый чемпионат Австралии по теннисуБадминтонБейсболБаскетболБиржевые ставкиБонусыБоксБундеслигаШахматыКолледжный баскетболКрикетЧемпионы ICCИндийская Премьер-ЛигаВелоспортДартсАнглийская Премьер-лигаКиберспортЗов долгаКСГОДОТА-2ФИФАЛОЛСтаркрафтВалорантМир WarcraftЧемпионат мира по футболу FIFAСтавки на хоккей с шайбойДрафт НХЛ 2025Чемпионат мира по хоккею с шайбой 2025Формула 1Открытый чемпионат Франции по теннисуБольшой шлем теннисаСобачьи бегаГандболХоккейСкачкиКентуккийское дербиЛа ЛигаСтавки в реальном времени�Мартовское безумиеММАМотоспортНаскарДрафт НБАДрафт НФЛОлимпиадаPGAПолитикаПолитика (Трамп)Политика (Камала)Политика СШАРегбиСерия АСнукерАвтогонки на серийных автомобиляхСупербоулНастольный теннисUFCUFC Fight NightВверх vs ВнизОткрытый чемпионат США по теннисуВолейболУимблдонЗимние виды спортаГольфФутболТеннис

- Лучшие криптовалютные картыКриптокарты без KYCКрипто кэшбэк картыКриптовалютные кредитные картыКрипто КартыКрипто дебетовые картыКрипто подарочные картыКрипто-карты MastercardКарты SolanaКриптовалютные предоплаченные картыКарты с криптовалютными вознаграждениямиКрипто виртуальные картыКрипто Visa картыВеб3 Карты

Торговые платформы

Избранные страницы

Что такое стейблкоины?

Похожие статьи

Начните здесь →

Что такое токены ERC-20?

Изучите основы стандарта токенов Ethereum, для чего используются токены ERC-20 и как они работают.

Читать статью →

Что такое токены ERC-20?

Изучите основы стандарта токенов Ethereum, для чего используются токены ERC-20 и как они работают.

Что такое DeFi?

Узнайте, как работают приложения децентрализованных финансов (DeFi) и как они сравниваются с традиционными финансовыми продуктами.

Читать статью →

Что такое DeFi?

Узнайте, как работают приложения децентрализованных финансов (DeFi) и как они сравниваются с традиционными финансовыми продуктами.

Что такое газ ETH и как работают комиссии в Ethereum?

Узнайте о единице измерения комиссий за транзакции в Ethereum, получите информацию о рынке комиссий Ethereum и узнайте, как настраивать комиссии, которые вы платите.

Читать статью →

Что такое газ ETH и как работают комиссии в Ethereum?

Узнайте о единице измерения комиссий за транзакции в Ethereum, получите информацию о рынке комиссий Ethereum и узнайте, как настраивать комиссии, которые вы платите.

Что такое «самокастодиальный» кошелек?

Поймите, как модель самостоятельного хранения дает вам контроль над вашими криптоактивами и защищает вас от рисков третьих лиц.

Читать статью →

Что такое «самокастодиальный» кошелек?

Поймите, как модель самостоятельного хранения дает вам контроль над вашими криптоактивами и защищает вас от рисков третьих лиц.

Bitcoin.com в вашем почтовом ящике

Еженедельное краткое изложение важных новостей, а также образовательные ресурсы и новости продуктов и услуг, поддерживающих экономическую свободу.

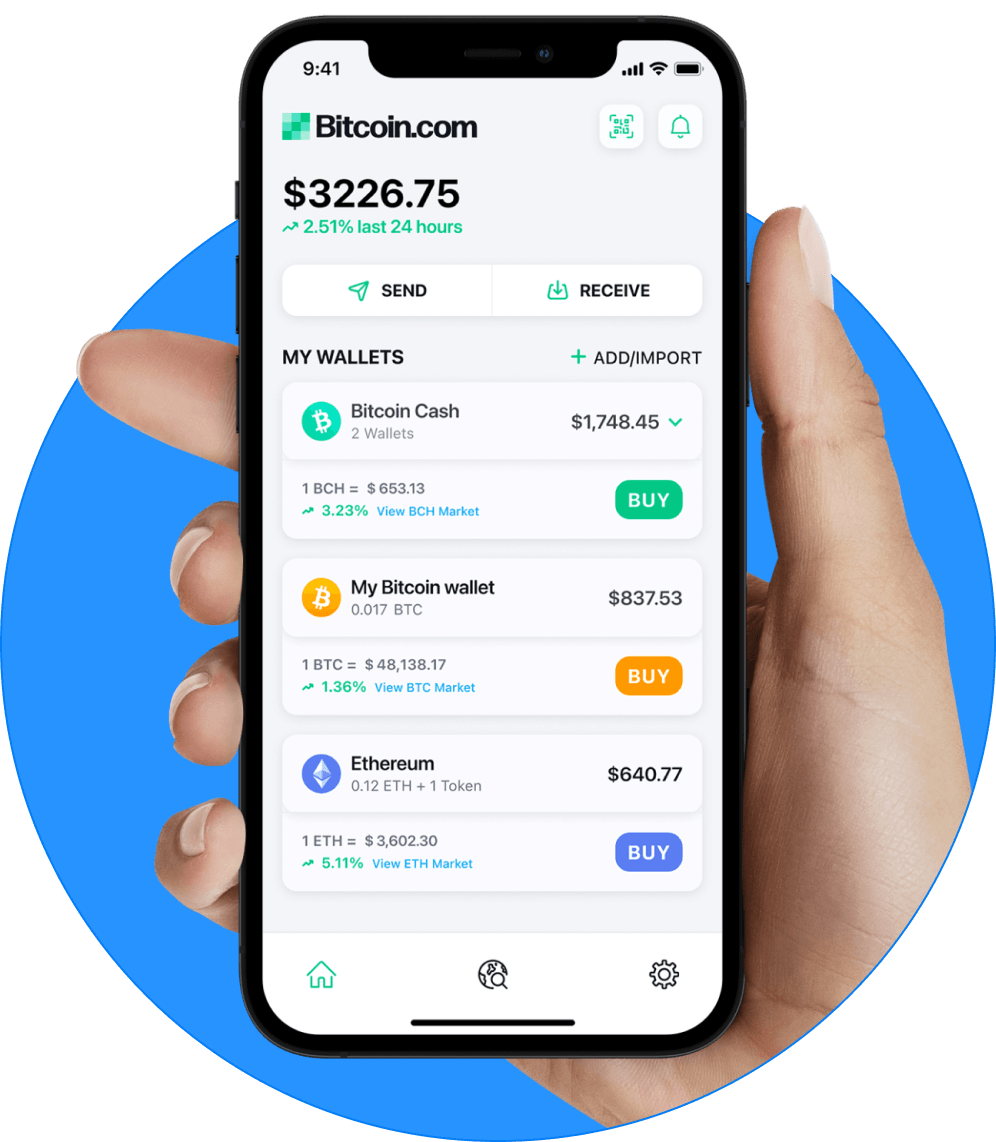

Начните безопасно инвестировать с Bitcoin.com Wallet

Все, что нужно для безопасной покупки, продажи, обмена и инвестирования биткоинов и криптовалюты