How does Bitcoin compare to other asset classes?

Last updated

Table of Contents

What is an asset class?

An asset class is a collection of investments that have similar characteristics and are subject to the same laws and regulations. Some common established asset classes include: stocks, bonds, gold, real estate, and fiat currencies.

Is Bitcoin an asset class?

Years ago declaring Bitcoin as a part of a new digital asset class was controversial, but with major traditional financial institutions such as Goldman Sachs admitting it is not only a new asset class, but an investable asset class, the tide has turned.

Comparing asset classes

Each asset class has strengths and weaknesses. For example, equities tend to outperform bonds and gold during times of high growth. Gold tends to do better than other assets in downturns or times of high inflation. Bitcoin seems to have properties of both equities and gold. It has done well during times of economic expansion, and it many argue it will act similarly to gold as a hedge in high inflation regimes.

Best performing assets

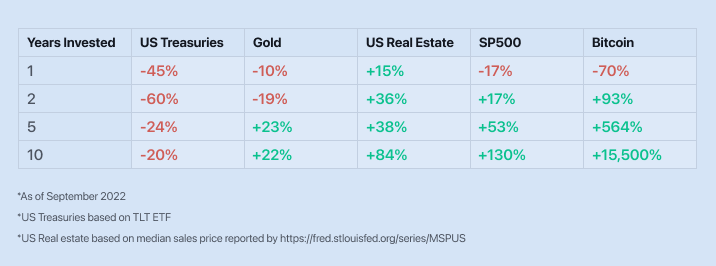

First, let’s compare several specific asset’s performance over the past ten years.

As you can see, Bitcoin has outperformed all of these assets, and it’s not even close. In fact, Even though it has made tremendous gains in the past ten years, it still represents only a tiny percentage of the market caps of both equities and gold. This indicates that Bitcoin’s growth still has plenty to go. But Bitcoin is more than just a high growth performer. It may also be a hedge against inflation.

Read more: Is Bitcoin a hedge against inflation?

Related guides

Start from here →

What is Bitcoin?

Get a straightforward introduction to Bitcoin and why it matters.

What is Bitcoin?

Get a straightforward introduction to Bitcoin and why it matters.

What is a Bitcoin wallet?

Learn about this essential tool for sending, receiving, and storing your bitcoin; how it works, and how to use it safely.

What is a Bitcoin wallet?

Learn about this essential tool for sending, receiving, and storing your bitcoin; how it works, and how to use it safely.

What's a 'self-custodial' wallet?

Understand how the self-custodial model puts you in charge of your cryptoassets and protects you from third-party risk.

What's a 'self-custodial' wallet?

Understand how the self-custodial model puts you in charge of your cryptoassets and protects you from third-party risk.

How to choose the best Bitcoin wallet

From security to fee customization options, these are the key factors to consider when choosing a Bitcoin wallet.

How to choose the best Bitcoin wallet

From security to fee customization options, these are the key factors to consider when choosing a Bitcoin wallet.

How does bitcoin exchange work?

How safe is it to store your crypto on centralized exchanges?

How does bitcoin exchange work?

How safe is it to store your crypto on centralized exchanges?

What is Bitcoin mining?

Learn why the process of minting new bitcoins, known as 'Bitcoin mining,' is in some ways similar to the process of extracting precious metals from the earth.

What is Bitcoin mining?

Learn why the process of minting new bitcoins, known as 'Bitcoin mining,' is in some ways similar to the process of extracting precious metals from the earth.

How do bitcoin transactions work?

Understand how the Bitcoin public blockchain tracks ownership over time. Get clarity on key terms like public & private keys, transaction inputs & outputs, confirmation times, and more.

How do bitcoin transactions work?

Understand how the Bitcoin public blockchain tracks ownership over time. Get clarity on key terms like public & private keys, transaction inputs & outputs, confirmation times, and more.

How does Bitcoin impact the environment?

As Bitcoin has become more mainstream, concerns about its environmental impact have become more numerous and pressing. Unfortunately, some of the criticisms have misrepresented the facts.

How does Bitcoin impact the environment?

As Bitcoin has become more mainstream, concerns about its environmental impact have become more numerous and pressing. Unfortunately, some of the criticisms have misrepresented the facts.

Is Bitcoin a store of value?

Learn how Bitcoin is similar or different to other stores of value, like fiat currency (US dollars) and precious metals (gold).

Is Bitcoin a store of value?

Learn how Bitcoin is similar or different to other stores of value, like fiat currency (US dollars) and precious metals (gold).

STAY AHEAD IN CRYPTO

Stay ahead in crypto with our weekly newsletter delivering the insights that matter most

Weekly crypto news, curated for you

Actionable insights and educational tips

Updates on products fueling economic freedom

No spam. Unsubscribe anytime.

Start investing safely with the Bitcoin.com Wallet

Over wallets created so far

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely

© 2026 Saint Bitts LLC Bitcoin.com. All rights reserved