Crypto derivatives have become the backbone of modern digital asset markets, powering liquidity and risk management for both retail and institutional players. In 2024, derivatives trading volumes dwarfed spot markets, with perpetual swaps alone reaching $58.5 trillion across major centralized exchanges and decentralized platforms posting 138% YoY growth. With institutions now driving over 80% of CEX activity and adoption accelerating in DeFi, derivatives are cementing their role as the primary growth engine of crypto finance.

Crypto Derivatives Market Breakdown

Key Highlights

Crypto derivatives have emerged as the silent engine driving crypto markets’ explosive growth and sophistication. These financial instruments linked to major digital assets like bitcoin, ethereum, and a host of altcoins form the backbone of institutional and retail trading strategies worldwide.

More than just speculative tools, crypto derivatives enable traders to hedge risks, manage exposure, and unlock liquidity without having to own the underlying asset. From massive hedge funds to individual retail traders, the use of derivatives such as futures, options, and perpetual swaps has become central to market participation. Derivatives trading now accounts for the majority of daily volume in crypto markets, dwarfing spot trading in both size and impact.

Understanding this fast-moving sector is essential not just for seasoned traders, institutional finance, and policymakers.

Market Growth

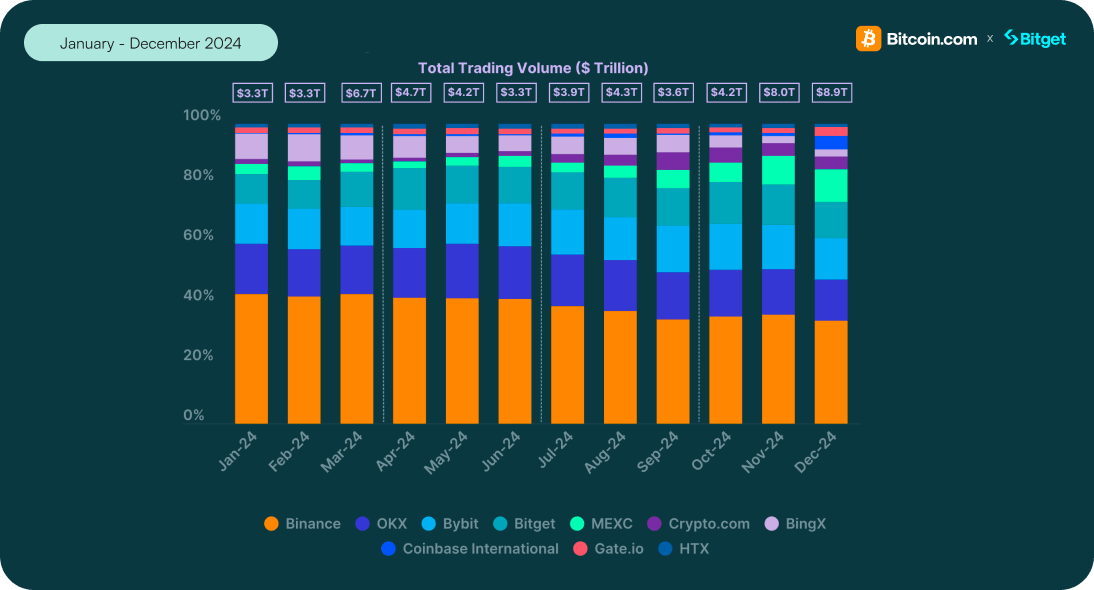

Perpetuals Boom: $58.5 trillion in trading volume across top 10 centralized exchanges (CEX) in 2024, up 79.6% in Q4 vs Q3.

Decentralized Derivatives: $1.5 trillion traded in 2024, +138.1% YoY growth.

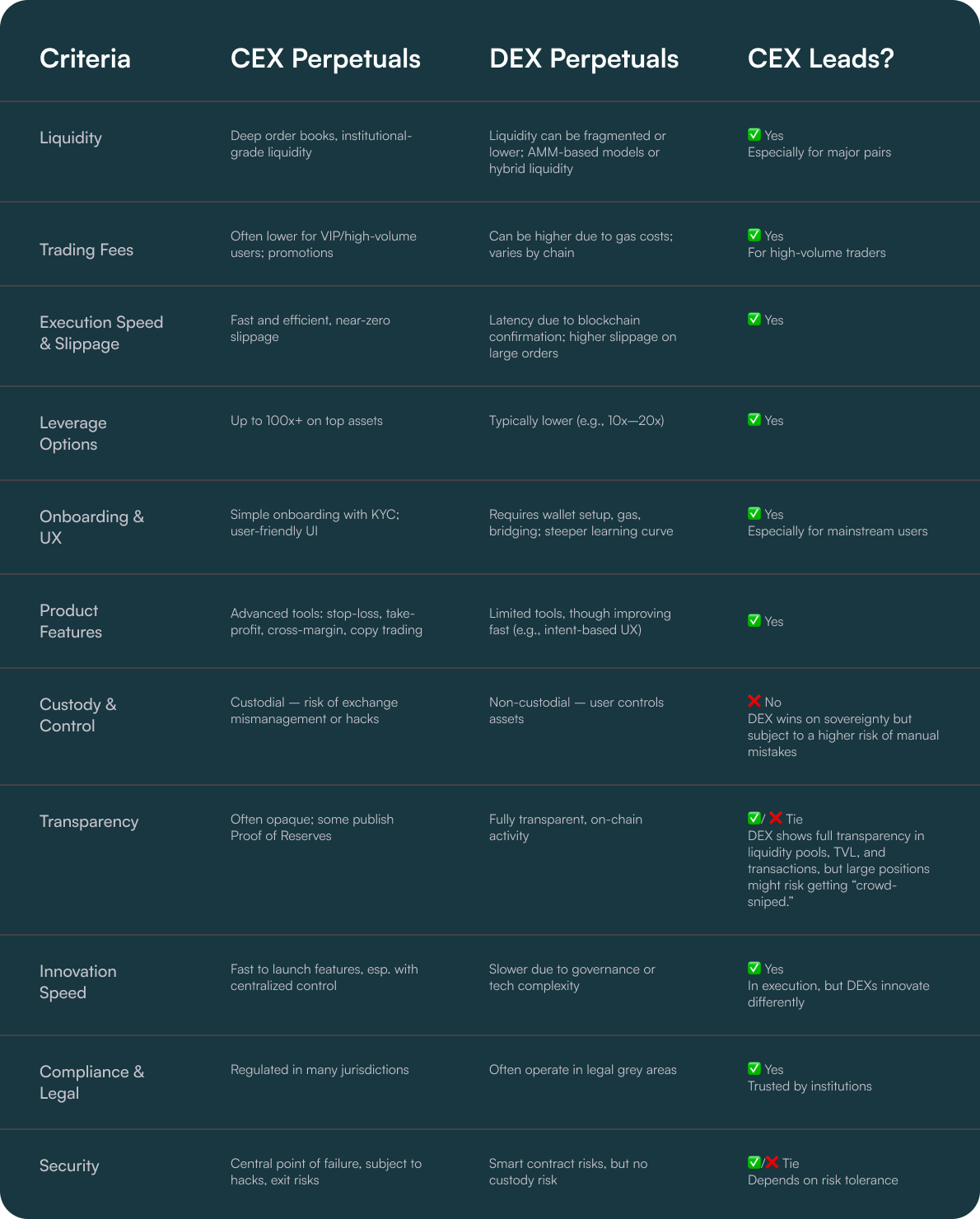

CEX vs Decentralized Perpetuals: A detailed comparison of CEX and DEX perpetual markets reveals key trade-offs between liquidity, slippage, fees, user experience, and composability. Currently, CEXs are leading in deep liquidity, better privacy, and lower latency trading for large position entities with prominent assets like BTC and ETH.

Global Record: Exchange-traded derivatives hit 20.09 billion contracts in Sept 2024, the highest ever.

Platform Dominance: Binance leads with 38% market share. Bitget rose to 3rd place, with $92 billion in April 2025 and market share up from 4.6% to 7.2% YTD.

Institutional Adoption: DeFi protocols and DAOs (e.g., treasury hedging with perps) are actively integrating derivatives. Stablecoins and growing TradFi interest are helping bridge crypto with global finance. In reality, it’s not the retail but institutional clients that account for over 80% of spot volumes on CEXs.

Outlook: With greater market maturity, capital efficiency, and use beyond speculation, crypto derivatives are becoming a foundational pillar in the evolving digital and traditional finance convergence.

Why Crypto Derivatives Matter Today: Capital Efficiency, Liquidity, Price Discovery

In traditional finance, derivatives are financial instruments whose value depends on the price movements of an underlying asset, such as equities, commodities, interest rates, or currencies. In the world of cryptocurrencies, derivatives mirror this concept but are pegged to digital assets like bitcoin, ethereum, and a host of altcoins.

These instruments have become foundational components of the broader digital asset ecosystem. Crypto derivatives play a critical role in enabling risk management, enhancing market liquidity, and facilitating price speculation. They also contribute to efficient capital deployment and help institutional players hedge their exposure. The rise of derivatives began in earnest in 2016 with the launch of perpetual swaps by BitMEX. Since then, the market has exploded.

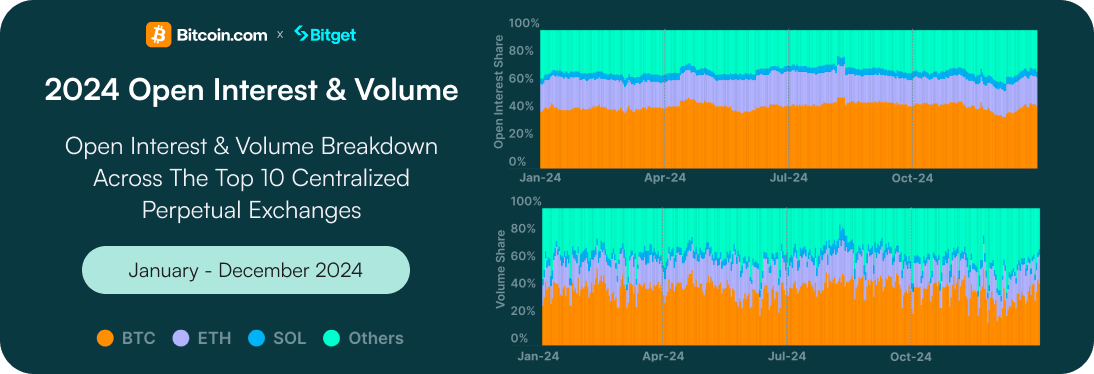

According to Coingecko’s State of Crypto Perpetuals 2024, the top 10 Centralized Perpetual Exchanges reported $21.2 trillion in trade volume in Q4 2024, a 79.6% increase from $11.8 trillion in Q3 2024. 2024 was the most active year for perpetuals trading ever, with $58.5 trillion in activity across the top 10 exchanges, with Bitcoin derivatives accounting for over 55% of total crypto derivatives volume.

Decentralized Perpetual Exchanges also recorded significant growth with $492.8 billion in trading volume in Q4 2024, an increase of 55.9% from Q3’s figure of $316.2 billion. In total, the top 10 decentralized exchanges recorded $1.5 trillion in trading volume in 2024, a jump of +138.1% from 2023’s figure of $647.6 billion.

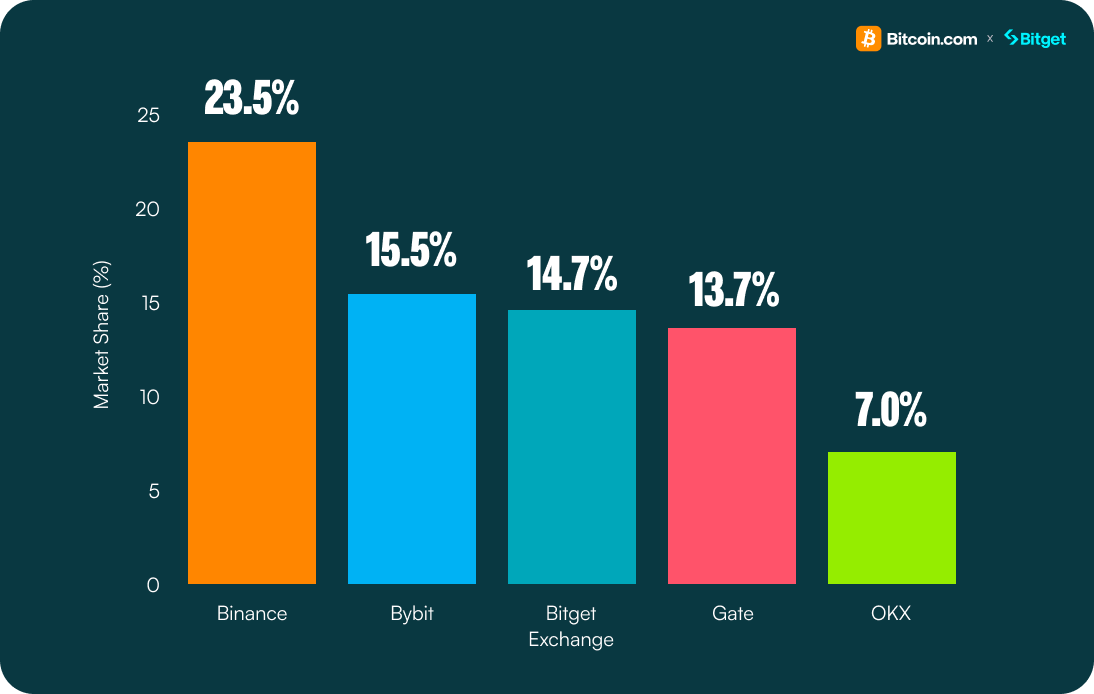

For Centralized Exchanges, Binance continues to dominate with a 38% market share. However, Bitget emerged as a stronger contender in 2025, shooting up to 3rd place in the market share rankings. At the end of April 2025, Bitget recorded $92 billion in trading volume, with its market share rising from 4.6% at the beginning of the year to 7.2%.

Globally, the volume of exchange-traded derivatives reached 20.09 billion contracts in September 2024, the highest level ever recorded. This staggering growth reflects increased institutional interest, market maturity, greater acceptance of cryptocurrencies in traditional finance, and enhanced trust in stablecoins, which are often used as quote assets in on-chain derivatives.

Institutional interest in derivatives, especially DeFi, grew notably with Decentralized Autonomous Organizations (DAOs) beginning to utilize derivatives for treasury management. For instance, some DAOs employ perpetual futures contracts to hedge against market volatility, ensuring the stability of their treasuries.

As the digital asset market matures, the use of derivatives has expanded beyond simple speculation. Today, they are used for DeFi protocol hedging, DAO treasury management, algorithmic trading strategies, and as capital-efficient hedging tools.

One of the most popular types of derivatives is futures contracts. Crypto futures are standardized agreements to buy or sell a digital asset at a predetermined price on a specified future date. These contracts allow traders to speculate on asset price movements without owning the underlying token. Unlike spot markets, futures enable leveraged exposure, directional bets, and portfolio hedging.

Settlement Types: Physical vs. Cash-Settled

Physical Settlement: Involves the actual delivery of the crypto asset upon contract maturity. Less common due to operational complexity.

Cash Settlement: Involves paying the profit or loss in fiat or stablecoins. This is the dominant model across most centralized platforms.

Major Exchanges

CME Group: The largest regulated U.S. derivatives exchange offering Bitcoin and Ether futures to institutions.

Binance, OKX, Bitget: Leading global exchanges offering high leverage, liquidity, and accessibility to both retail and institutional traders.

Bridging CEX Efficiency With DEX Access

Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs) have long shaped the crypto industry. CEXs like Binance, OKX, Bybit, and Bitget offer unmatched speed, deep liquidity, and professional-grade trading tools, but they come at the cost of custodial control of wallets. DEXs, on the other hand, embody the ethos of decentralization, allowing peer-to-peer trading without intermediaries. However, challenges include fragmented liquidity, slower execution speeds, complex interfaces, and limited support for novice users.

This gap between CEX convenience and DEX autonomy is shrinking fast, thanks to a new generation of hybrid solutions and cross-platform integrations that aim to combine the best of both worlds.

A look at hybrid solutions from CEXs shows a heavy investment in user-friendly Web3 wallets with intuitive interfaces, integrated trading support, and smooth on-chain asset management. For example, CEX-linked wallets now offer multi-chain asset handling, real-time price feeds, fiat on-ramps, and swap aggregators, making Web3 navigation seamless.

Several major exchanges have rolled out comprehensive Web3 wallets that extend their reach into the DeFi space, such as Trust Wallet, owned by Binance, which offers native staking, DApp browsing, and direct token swaps, all integrated with Binance’s ecosystem for seamless asset transfer between CEX and DEX. Other exchanges such as OKX and Bybit also have similar Web3 wallets with multi-chain support, NFT marketplaces, and DeFi yield services.

Bitget Web3 Wallet stands out with its support for 90+ blockchains and positions itself as an all-in-one Web3 gateway, featuring DeFi access, DApp discovery, and cross-chain swaps, seamlessly connected to Bitget’s trading platform.

Building on the success of the Bitget Wallet, Bitget Onchain marks a strategic leap in crypto derivatives by uniting CEX reliability with DEX access. Embedded directly into the Bitget App, this feature allows users to trade on-chain assets using USDT or USDC from their spot accounts. It simplifies the often complex on-chain trading process while maintaining CEX-level security, particularly important for onboarding new retail users exploring decentralized markets. Initial blockchain support includes Solana, BNB Smart Chain (BSC), and Base, with real-time access to over 30 on-chain tokens.

A standout element of Bitget Onchain is its integration of AI-powered smart screening to filter and evaluate emerging tokens in real time. This reduces exposure to risky assets and enhances investment decision-making, critical in volatile on-chain environments. The move complements Bitget’s broader AI initiative, which includes trading bots, risk management tools, and predictive analytics.

This unified ecosystem, where centralization and decentralization coexist popularly known as CeDeFi, gives CEX-backed ecosystems a competitive edge in market insights, research tools, user guidance, and risk management.

Exchange Depth

While Binance and OKX remain the largest crypto derivatives platforms by trading volume, appealing to both retail and institutional users, Bitget has carved out a distinct niche focused on accessibility, copy trading, and innovation tailored for retail traders.

Bitget supports contract sizes starting as low as 0.001 BTC or 1 USDT, with leverage of up to 125x for select perpetual contracts. The exchange has rapidly gained market share by offering intuitive features like one-click copy trading, enabling less experienced users to mirror the strategies of top-performing traders.

As of Q4 2024, Bitget futures trading volume reached $16 billion, reflecting increased user engagement and market activity. According to CoinGecko’s State of Crypto Liquidity on CEXs 2025 report, Binance leads the way on BTC depth, followed by Bitget and OKX. Liquidity on most exchanges shows a steadily increasing slope, indicating good liquidity across depth levels. 32% of this liquidity is on Binance, supporting an orderbook depth of around $8 million each on both buy and sell sides. This is followed by Bitget with $4.6 million and OKX with $3.7 million.

Binance caters to large institutional players through its deep liquidity pools, offering a broader range of contract types, including coin-margined futures, and maintains high open interest across its BTC and ETH perpetual markets.

OKX provides slightly lower leverage (up to 100x) but boasts strong trading tools, attracting quantitative traders and developers. It has also integrated unified accounts for margin and futures, giving traders greater capital efficiency across products. For ETH, Bitget surpassed Binance as the most liquid exchange within the +/- $15 (1% range), followed by OKX. Nevertheless, liquidity at this range is quite healthy across the benchmarked exchanges, with 6 exchanges having liquidity above $1 million or more. Bitget also leads on XRP, SOL.

This shows a clear trend: Binance and OKX dominate in depth and institutional appeal, while Bitget thrives by innovating around usability and social trading dynamics. Currently, Bitget works with over 1,000 institutional clients while Bybit caters to an estimated 1,500 institutional clients.

Since January, Bitget has supercharged its institutional offerings, like leveling up its lending program, boosting liquidity incentives, and prepping unified margin accounts for Q3 to maximize capital efficiency. The results show that 80% of top crypto quant firms now trade on Bitget, with institutional clients driving 80% of spot volume, matching Coinbase.

Institutional assets under management (AuM) have doubled with Bitget’s share of futures volume doubling to 50% in just 6 months, targeting 70%+ by year-end. CEX liquidity for the top 5 crypto assets is generally healthy, with Binance offering the most liquidity for BTC, while Bitget is the most liquid platform for altcoins within the 0.3% – 0.5% price interval.

User Profile

Institutional Hedgers: Asset managers and corporate treasuries often use futures to lock in crypto values over a planning horizon. With trading positions ranging from $5 million to $500 million per position, this strategy is employed on large spot BTC or ETH holdings to protect portfolio value from market downturns. For example, a hedge fund with a $200 million Bitcoin position may short CME BTC futures worth $50 million to $150 million to reduce risk exposure.

Speculators: Retail or professional traders who take long or short positions, aiming to profit from volatility with a typical trading range of $1,000 to $500,000 per position. A swing trader may open a $50,000 BTC perpetual contract using 10x leverage with $5,000 margin during bullish sentiment, targeting outsized gains.

Prop Firms: High-frequency trading firms or arbitrage desks use futures to profit from market inefficiencies, with capital size ranging from $500,000 to $100 million+. For example, a firm might simultaneously buy BTC spot and short BTC futures when futures are overpriced, capturing the basis spread.

Perpetual Swaps – the Volume Game

What Makes Them Unique

Perpetual swaps (perps) are futures contracts without an expiration date. They maintain price parity with spot markets through a funding rate mechanism: when the perpetual trades above spot, longs pay shorts, and vice versa. This structure allows traders to hold positions indefinitely without rolling contracts.

Dominance in Trading Volumes

Perpetuals dominate crypto derivatives trading, accounting for over 70% of total volume. Their high leverage and simplicity attract both novice and professional traders alike.

Open interest (OI), the total value of active, non-closed derivative contracts, is a vital gauge of market depth and trader commitment, with OI hitting record highs above $80 billion in late May. Binance remains the clear frontrunner in both volume and OI, though its lead is being closed down by Bybit and Bitget.

Comparison of CEX vs DEX Perpetuals – Who’s Better?

Use-Case Scenarios

Retail Small-Cap Trading

Ease-of-use, fees, and fiat onramps shape the retail journey. For users trading $1k–$10k, a clean UI, low fees, and easy onboarding are essential. Bitget offers simple KYC, low minimum deposits, and intuitive margin features like isolated/cross modes. Maker-taker fees start at 0.02%–0.06%, and can be reduced to ~0.015% using BGB token discounts or rebates for passive orders. Similarly, Binance and Bybit provide competitive fee tiers (e.g., Binance with 0.02% maker and 0.04% taker for VIP 0, lower at higher volumes), but sometimes require heavier identity verification and can be more complex for first-time users.

In contrast, DEXs like GMX and Hyperliquid allow instant access via wallet, avoiding KYC altogether. This is attractive for crypto-native or privacy-focused traders. However, a $10k trade on GMX might incur ~$35–$70 in fees depending on pool usage and volatility, versus ~$6 or less on CEXs. Hyperliquid’s custom L1 offers fast settlement, but the initial setup (wallet bridging, RPC configs) remains a barrier. Onboarding fiat is also easier with CEXs: Bitget, Binance, and Bybit offer direct card, bank, and P2P options, while DEXs require users to first acquire and bridge crypto.

Verdict: CEXs (Bitget, Binance, Bybit) are better suited for retail traders prioritizing low fees, fiat integration, and convenience. DEXs offer anonymity and self-custody, but add operational complexity for non-crypto-native users.

Institutional/High-Volume Trading

Fee efficiency, execution speed, and capital utilization are critical. Institutions trading $1M+ focus on tight spreads, block liquidity, and margin optimization. Binance remains the industry leader in terms of order book depth and institutional infrastructure, offering the lowest taker fees (down to 0.01%) and direct API & sub-account access. Bitget and Bybit are catching up, with VIP programs dropping fees to 0.015% or lower and offering Unified Margin Systems to trade with cross-asset collateral.

Bitget, in particular, supports large trades with its deep futures markets, real-time liquidation engine, and position risk tiers—which reduce the chances of cascading liquidations. Binance supplements this with block trading portals and robust risk metrics, while Bybit’s Unified Trading Account (UTA) offers similar capital efficiency across spot, margin, and derivatives.

On the DEX side, Hyperliquid is the standout, with ~$3–4B daily volume and an order-book DEX model that mimics CEX functionality. Still, there are no VIP tiers or fee rebates; a $10M trade at 0.05% results in $5,000 in fees, regardless of size or loyalty. GMX uses an AMM model with higher slippage and lower depth, making it less suitable for institutional flows.

Legal clarity is also a major factor. CEXs generally provide licensed jurisdictions, compliance tools, and audited operations, while DEXs are permissionless but expose institutions to smart contract and regulatory risks.

Verdict: For institutional or high-volume users, CEXs (especially Binance for scale, Bitget for fee flexibility, and Bybit for system unification) remain the preferred venue. DEXs like Hyperliquid are gaining ground in DeFi-native institutional trading but remain secondary due to compliance and cost factors.

DeFi-Native/Integrated Trading

Composability, control, and yield define the DeFi-native playbook, but transparency has its tradeoffs. On-chain perpetual DEXs like GMX and Hyperliquid attract traders with features that allow them to integrate positions across DeFi protocols. These include yield-generating LP tokens (e.g., GLP or HLP), governance incentives, and smart contract interoperability. Composability allows strategies such as using LP shares as collateral in lending protocols, automated rebalancing, and portfolio yield stacking.

However, recent trading incidents have exposed a significant downside of full transparency: position sniping. Since trades, liquidations, and pending orders are visible on-chain, sophisticated bots and adversarial traders can front-run or counter-trade large positions.

In April 2025, several high-leverage positions on Hyperliquid and Aevo were reportedly “sniped,” their liquidation thresholds were monitored via public mempools, and opposing positions were strategically opened to force or profit from their forced exits. These practices, while not always illegal, raise fairness concerns and highlight the absence of execution privacy on-chain.

In contrast, CEXs like Bitget, Binance, and Bybit offer opaque order books and protected execution environments. Large orders can be broken up, routed through dark pools, or executed via OTC desks to minimize slippage and front-running. Bitget also provides risk management automation (like Smart TP/SL orders and multi-tier margin protection) and internalized liquidation mechanisms that reduce on-chain predation.

Bitget’s Onchain platform mitigates some DeFi risks while preserving accessibility: although it taps into token listings across chains like Solana and BNB Chain, execution is centrally managed. This avoids front-running, while still offering high-speed trading and DeFi asset access — a middle ground between CEX protection and DeFi exposure.

Verdict: While DEXs provide flexibility and yield for power users, their full transparency can expose traders to predatory behaviors like liquidation sniping. For those seeking safer execution with comparable DeFi exposure, Bitget Onchain or traditional CEXs offer stronger trade privacy and defense mechanisms.

Bitcoin and Derivatives: Anchoring the Market’s Core

Bitcoin remains the cornerstone of the crypto derivatives market, consistently accounting for the majority of open interest and trading volume across futures and options platforms. As the first and most widely held digital asset, BTC serves as the primary benchmark for investor sentiment and a critical hedging instrument for both institutional and retail market participants.

Futures and perpetual swaps on bitcoin provide traders with flexible ways to speculate on price movements, manage portfolio risk, and conduct basis or funding rate arbitrage. Meanwhile, bitcoin options enable complex strategies such as covered calls, protective puts, and straddles. These instruments have become vital during macro uncertainty, allowing market participants to express directional bias or protect long holdings amid volatility.

As bitcoin derivatives continue to mature, Bitcoin.com’s mission to empower users with knowledge and tools positions it as a key enabler of responsible derivatives usage. Its efforts support broader financial inclusion and help bridge the gap between new adopters and complex financial products that were once the domain of professionals alone.

Options Trading – Financial Flexibility

Options give holders the right, but not the obligation, to buy (call) or sell (put) an asset at a specific strike price before expiration. They allow traders to speculate on volatility, hedge portfolios, or construct complex strategies for asymmetric risk-reward.

On Deribit, the largest crypto options exchange, volatility skew tends to exhibit an inverse pattern to traditional equity markets like the S&P 500 (SPX). In SPX options, the implied volatility is typically higher for puts (downside protection) than for calls, reflecting institutional hedging against market crashes, known as a negative skew.

In contrast, crypto often displays positive skew, especially during bull markets, where out-of-the-money calls command higher implied volatility than puts. This is due to the retail-driven demand for speculative upside exposure and the potential for parabolic moves, particularly in assets like BTC and ETH.

Crypto options settle in the underlying (e.g., BTC or ETH), adding a layer of complexity absent in most TradFi options, which are cash-settled or expire worthless. The 24/7 market also means risk management must be continuous, with no overnight gaps, but also no downtime.

Use Cases

TradFi Institutions: In SPX markets, institutional investors deploy structured hedging strategies like protective puts or collar strategies to manage risk across large portfolios. Market makers, pension funds, and large asset managers also rely on deep liquidity and long-standing pricing models with average daily notional trading volumes exceeding $1.5 trillion.

Crypto Traders: In crypto, volatility trading dominates. Sophisticated participants use straddles, strangles, or butterfly spreads to capture directional and volatility plays, particularly on Bitcoin and Ethereum options, with daily volumes approaching $2–5 billion notional. Because of crypto’s high implied vol and rapid price swings, selling premium (e.g., via covered calls or cash-secured puts) is often more lucrative, but riskier than in TradFi.

Institutional Strategies

Volatility Hedges: Protect against sharp price movements.

Income Generation: Through writing calls/puts.

Structured Products: Built for customized risk management and payouts.

Retail Access and Innovation

Retail investors can now access structured yield with options packaged into simple vaults, democratizing advanced tools for non-professionals. Crypto options “vaults” are structured financial products that automate options trading strategies to generate yield, often without requiring users to actively manage trades or understand complex options mechanics.

Retail users deposit assets, typically ETH, BTC, or stablecoins, into a vault smart contract. These assets act as collateral for the vault’s options strategies. Each vault runs a predefined options strategy on a weekly or bi-weekly cycle, with common strategies including covered calls and cash-secured puts. Premiums from the sold options are collected and distributed proportionally to vault participants. This forms the basis of the vault’s yield.

Vaults bridge the gap between complex options strategies and everyday DeFi users. By abstracting away execution, risk modeling, and rolling logistics, they democratize access to yield in a market that typically favors sophisticated traders. For many, they represent the first step toward participating in options without needing to manage expirations or volatility forecasts.

Market Participants and Use Cases

Retail Traders: Seek exposure, leverage, and structured returns.

Institutions: Use derivatives for capital-efficient strategies and hedging.

Market Makers: Ensure liquidity and arbitrage inefficiencies.

DAOs: Manage treasuries with options and futures for long-term sustainability. One leading example is MakerDAO, the protocol behind the DAI stablecoin, which uses options strategies to hedge and optimize the reserve backing its stablecoin.

MakerDAO holds a diverse treasury, including USDC, ETH, and RWAs (real-world assets) to collateralize DAI. To hedge against downside volatility and preserve DAI’s peg integrity, MakerDAO allocates a portion of its ETH and stablecoin reserves to put options and protective collars. In addition to hedging, Maker also uses options to generate non-dilutive yield, allowing it to enhance returns on idle treasury capital while maintaining capital efficiency.

Primary Use Cases

Hedging: Protecting asset portfolios. Crypto derivatives offer institutional traders the ability to hedge exposures efficiently without tying up large amounts of capital. A prominent method in this playbook is the delta-neutral strategy, where the trader aims to offset directional risk, effectively isolating volatility or basis opportunities.

Delta-neutral structures are particularly popular during sideways or uncertain markets, when directional bets are risky but volatility-based income is attractive. These strategies are widely used by market-neutral hedge funds, crypto-native prop desks, and liquidity providers seeking to smooth returns and manage risk across large books.

Speculation: Taking directional bets or leveraging short-term price views.

Arbitrage: Taking advantage of inefficiencies between spot and derivatives markets.

Impact on Market Efficiency

Derivatives improve liquidity, enhance price discovery, and facilitate smoother markets. With derivatives, participants can trade views on volatility, asset direction, and market correlation in a capital-efficient way.

One striking example of how crypto derivatives contribute to market efficiency was seen during the U.S. regional banking crisis in March 2023. As panic triggered a run on institutions like Silicon Valley Bank and Signature Bank, Bitcoin initially surged amid a broader risk-off move and increasing speculation that it might serve as a hedge against banking instability. BTC futures open interest spiked, enabling traders to express both bullish and bearish views in real time.

Notably, while BTC spot prices briefly surged, robust liquidity in the futures markets allowed for rapid repricing as rate cut expectations shifted. This helped stabilize price discovery and narrow spreads between spot and futures markets. The use of BTC futures allowed institutional and retail participants to hedge exposure or capitalize on short-term dislocations without overwhelming spot liquidity.

Regulatory Landscape

While the U.S. CFTC regulates derivatives trading, especially for institutional players, decentralized platforms operate in regulatory gray areas. Jurisdictions like Singapore and the EU are setting frameworks to encourage innovation while ensuring consumer protection.

The European Union’s Markets in Crypto-Assets (MiCA) regulation, implemented in 2025, aims to harmonize crypto oversight across the bloc. While MiCA focuses heavily on stablecoins and asset-referenced tokens, its approach to derivatives is more conservative.

Under current EU law, crypto derivatives are largely regulated under existing financial frameworks, such as the Markets in Financial Instruments Directive (MiFID). This means that providers offering futures or options on digital assets must be authorized as investment firms and comply with stringent investor protection, conduct, and risk management requirements.

MiCA adds clarity by establishing uniform licensing across member states but leaves room for national authorities to impose additional restrictions on leveraged products, particularly those marketed to retail users.

In contrast, Singapore’s Monetary Authority of Singapore (MAS) has opted for a more flexible but highly selective approach. MAS requires derivatives on payment tokens, such as BTC and ETH, to be traded only on approved exchanges, with an emphasis on institutional participation. Retail access to such products is tightly controlled.

The MAS framework emphasizes risk disclosure, segregated client assets, and anti-money laundering protocols, aligning with its broader strategy to attract regulated digital asset activity while minimizing consumer harm. Unlike the EU, Singapore has been more cautious about retail exposure to derivatives, citing volatility and leverage risks.

In the regulatory race, top-tier exchanges like Binance, Bitget, Bybit, and OKX are at the forefront: Binance holds licenses in multiple regions, including a Class 3 VFA License in Malta, a Virtual Asset Service Provider (VASP) registration in Poland and Lithuania, and regulatory clearance in Dubai and other emerging crypto hubs.

Bitget has secured regulatory approval in key jurisdictions like Lithuania and Seychelles, with further compliance achievements positioning it to offer derivatives services to European and APAC traders.

Bybit recently acquired a MiCAR license from the Austrian Financial Market Authority (FMA), enabling it to passport regulated crypto-asset services to all 29 EEA member states. This milestone sharply boosts its European derivatives credibility.

OKX has obtained a VASP license in Dubai and crypto licenses in jurisdictions such as the Bahamas, offering institutional-grade services in emerging regulated crypto centers.

In the United States, the Commodity Futures Trading Commission (CFTC) continues to assert its jurisdiction over crypto derivatives, particularly those involving BTC and ETH.

A landmark enforcement action came in November 2023 when Binance agreed to a $4.3 billion settlement with the CFTC and other federal agencies. The case underscored regulators’ growing insistence that offshore platforms comply with U.S. rules when serving American users.

Conclusion

Crypto derivatives have transformed the way participants interact with the digital asset space. From basic hedging to sophisticated trading strategies, derivatives now represent a key pillar of the crypto economy. As markets evolve and regulatory clarity expands, futures, perpetuals, and options will only become more integral to portfolio management, liquidity provision, and financial innovation, with the next phase of growth likely involving tighter integration between centralized finance and DeFi.

Looking ahead, the next evolution in crypto derivatives is likely to be shaped by AI and interoperability. AI-driven trading platforms are emerging to automate strategy selection, risk management, and portfolio optimization, giving both institutional and retail users an edge in increasingly complex markets. Meanwhile, cross-chain derivatives settlements powered by interoperability protocols like Layerzero or Axelar could break down current silos, enabling margin and collateral to flow seamlessly across ecosystems.

As tokenized real-world assets (RWAs) gain traction, expect more hybrid derivatives blending on-chain assets with traditional financial instruments, pushing the crypto derivatives market deeper into mainstream finance and defining the next era of digital financial infrastructure.

Download the full report: Crypto Derivatives 101 – Market Breakdown: Who’s Winning the Race?