What is Verse?

Last updated

VERSE will enable anyone to receive rewards for buying, selling, spending, swapping, and staying informed about crypto. At the same time, VERSE tokens will provide utility within and beyond Bitcoin.com’s ecosystem. Use cases will include unlocking rewards along tiers, method of payment, access to exclusive platform services and more.

Table of Contents

Why VERSE?

Since 2015, Bitcoin.com has been a global leader in introducing newcomers to cryptocurrency. Our mission is to create economic freedom, which we define as the ability for individuals to freely acquire and use personal resources however they choose. We build products and services that give everyday people access to a vast world of opportunities to generate personal prosperity without limits.

By providing a powerful combination of rewards and utility, VERSE will help expand access to decentralized finance (DeFi). Ultimately, this will enable more people to safely benefit from the economic freedom and democratized finance it unlocks.

Read the Verse white paper here to find out more about the Bitcoin.com ecosystem, how VERSE fits in, and the synergy created.

What can VERSE be used for now?

VERSE utility is gradually being intergrated to the Bitcoin.com ecosystem. You can discover VERSE use cases on the web here or in the Bitcoin.com Wallet app by tapping on Verse Explorer from the app's home screen.

Verse dApps

The first wave of Verse dApps include the following:

Verse Scratcher Verse Scratcher enables anyone to purchase digital tickets and "scratch" them to reveal the numbers. If three matching numbers are revealed, you win a prize, which is paid in VERSE. Learn more about Verse Scratcher and how to use it here.

Verse Clicker Verse Clicker is a free-to-play game where you click for points and spend points within the game to purchase upgrades. Hold and use VERSE within the Verse ecosystem to get exclusive bonuses that enable you to dominate the leaderboard. Prizes are available during limited-time campaigns. Learn more about Verse Clicker and how to use it here.

Verse Burn Engine The Verse Burn Engine allows anyone to trigger “burns” of VERSE tokens. When tokens are burned, they are no long accessible, meaning the total supply of VERSE is reduced forever. Anyone can permanently reduce the supply of Bitcoin.com’s ecosystem token VERSE by triggering the Verse Burn Engine. Learn more about Verse Burn Engine and how to use it here.

Verse Lounge Verse Lounge is an exclusive community for VERSE token holders who want to connect. The key benefits of joining Verse Lounge are:

- Talk with Verse Builders

- Engage with fellow holders

- Participate in voting on proposals relevant to the Bitcoin.com Verse ecosystem

- Be the first to know about new features and Verse products

- Get access to additional perks available only to Lounge members. Learn more about Verse Loung and how to join it here.

Verse DEX

VERSE utility includes liquidity providing and yield farming on Bitcoin.com's decentralized exchange Verse DEX. The Verse DEX is a core piece of infrastructure in the Bitcoin.com Verse ecosystem as it enables permissionless and low-fee trading. To function efficiently, Verse DEX needs to attract sufficient liquidity from market participants. Liquidity, as measured by total value locked (TVL), is a key measure of the health of a decentralized exchange. Rewards for liquidity providers and Verse Farms rewards are designed to incentivize the growth of liquidity on the Verse DEX. Learn more about Bitcoin.com's Verse DEX here.

Earn VERSE by providing liquidity on the Verse DEX

You can start earning VERSE (and other cryptocurrencies) by providing liquidity to any VERSE pool on the Verse DEX. Check the rewards, measured in APY, available right now on Verse DEX pools here. This step-by-step guide explains how to contribute to liquidity pools and earn yield on Verse DEX.

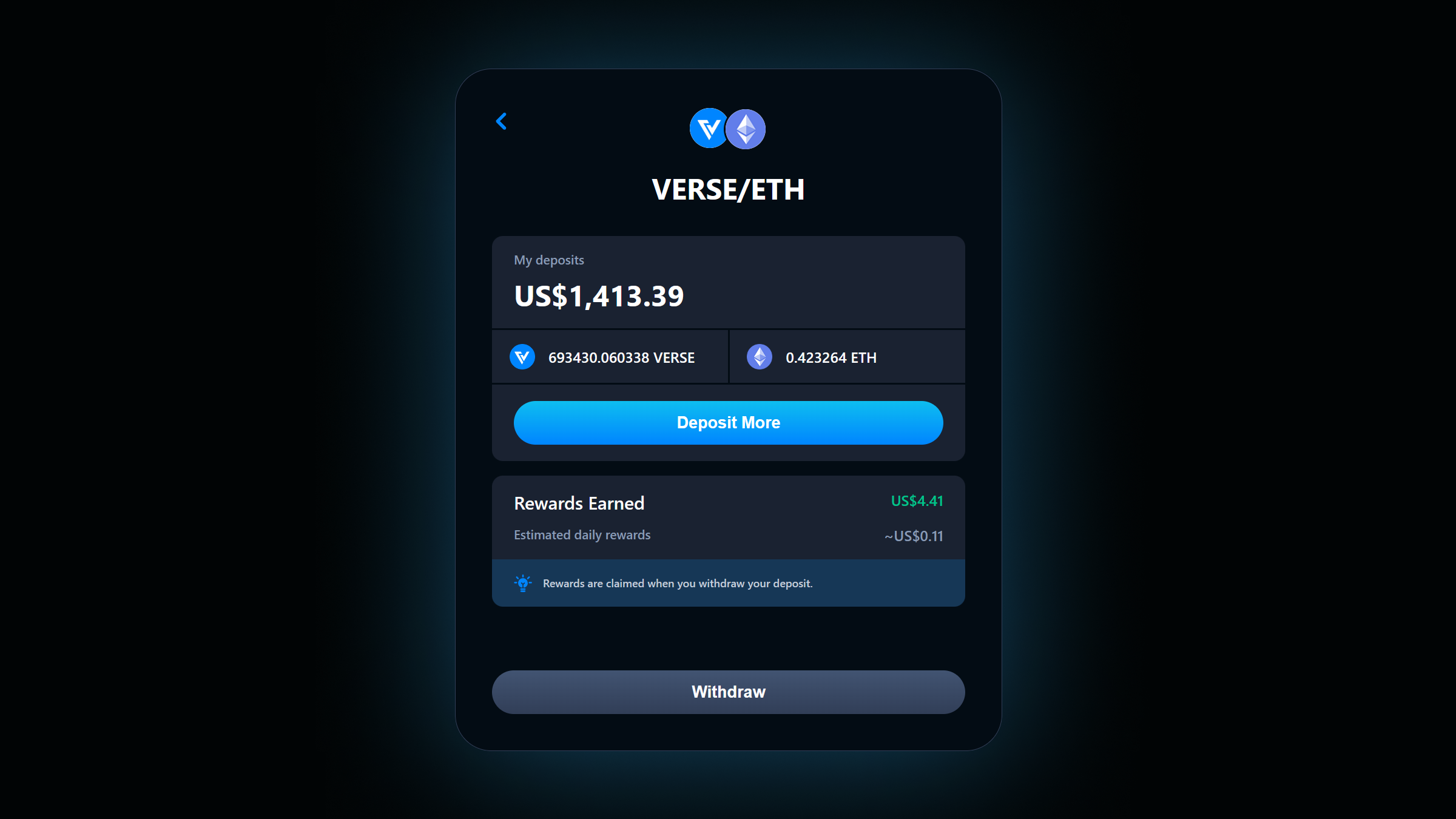

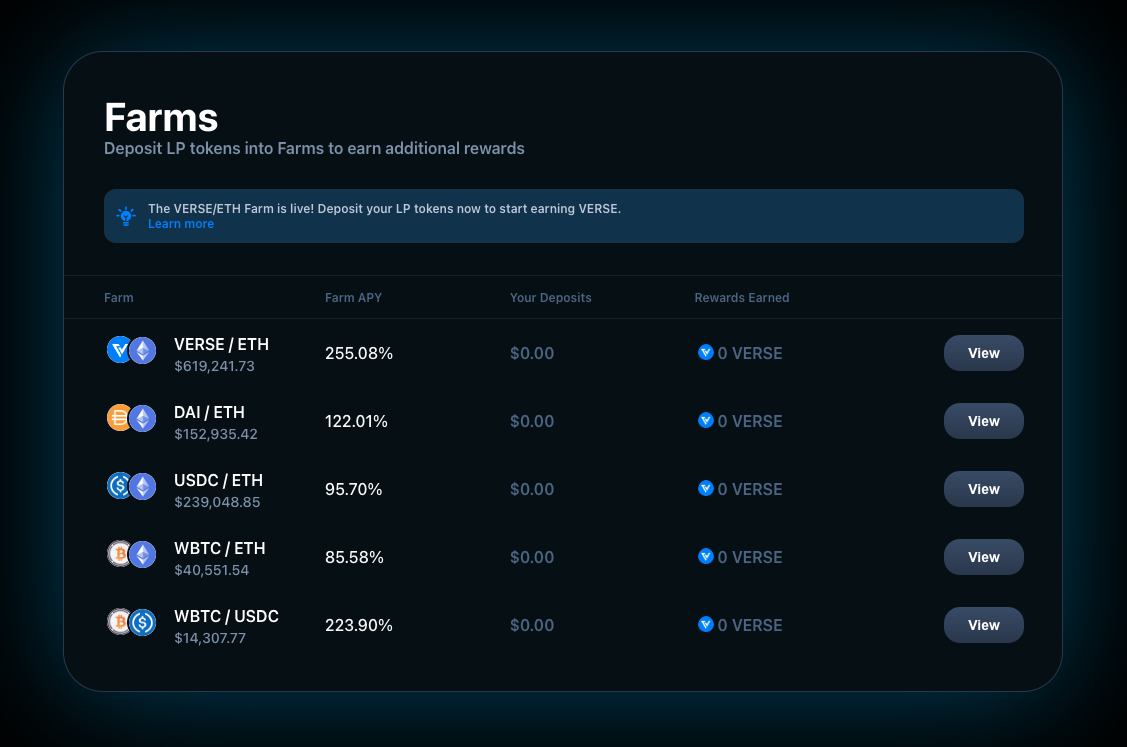

Earn rewards in Verse Farms

Anyone can deposit select Liquidity Pool (LP) tokens into Verse Farms and start earning. Learn more about Verse Farms, how you can start earning APY, where the yield comes from, and get answers to other frequently asked questions with this guide.

Stake VERSE to earn rewards Now it’s easier than ever to earn VERSE rewards. Simply deposit your VERSE tokens on Bitcoin.com’s decentralized exchange Verse DEX and start earning rewards automatically. Use this straightforward guide to start staking now.

How can I buy or trade VERSE?

You can buy or trade VERSE with cash in the Bitcoin.com Wallet app or on the web here. You can trade VERSE in the app, via Bitcoin.com’s decentralized exchange Verse DEX, and through a range of third-party exchanges and service providers. Please find more details on this page.

VERSE in Detail

VERSE is an ERC-20 token that lives on the Ethereum and Polygon PoS public blockchains. Bitcoin.com is dedicated to ensuring that VERSE has wide utility for everyday people, which is why VERSE will be integrated across low-fee chains.

A maximum of 210 billion VERSE will be minted over seven years starting from the contract deployment date, which was Dec 7, 2022. The majority of VERSE tokens (69%) are reserved for community and ecosystem development.

The VERSE tokenomics are designed to support longevity and growth.

- VERSE had a fair launch: We created a highly publicized multistage token sale where 1) The sale terms were public, and 2) There were no steep discounts between rounds.

- There are no cliffs: VERSE tokens purchased in the sale began unlocking on day 1, and continue unlocking for 12 to 18 months. Team tokens also unlock linearly, but over a four-year period.

- Buyback and burn: We’ve baked an ongoing deflationary mechanism into Verse where a portion of all the fees generated are used to buy back and burn VERSE.

- Community development: The VERSE token will spearhead initiatives to accelerate growth and innovation. The Verse Development Fund (34% of total supply) will provide a pipeline of resources for DApps integrating with the ecosystem and will incubate token projects through the Bitcoin.com launchpad service (coming soon).

Learn more about Verse

- Follow the Verse Official blog here. Recommended articles to get started include Top Four Reasons to Buy VERSE and The Bitcoin.com Ecosystem, How VERSE Fits In, And The Synergy Created.

- Use the Bitoin.com Support Center Verse Dashboard for step-by-step guides.

- Join the Verse community on Discord and Telegram

- Read the Verse white paper here.

Related guides

Start from here →

What is Verse DEX?

Learn about Bitcoin.com’s official decentralized exchange and how to use it to trade and to earn.

What is Verse DEX?

Learn about Bitcoin.com’s official decentralized exchange and how to use it to trade and to earn.

How do I buy VERSE?

Learn how to get Bitcoin.com’s ecosystem token VERSE in the Bitcoin.com Wallet app, via Bitcoin.com’s decentralized exchange Verse DEX, and more.

How do I buy VERSE?

Learn how to get Bitcoin.com’s ecosystem token VERSE in the Bitcoin.com Wallet app, via Bitcoin.com’s decentralized exchange Verse DEX, and more.

STAY AHEAD IN CRYPTO

Stay ahead in crypto with our weekly newsletter delivering the insights that matter most

Weekly crypto news, curated for you

Actionable insights and educational tips

Updates on products fueling economic freedom

No spam. Unsubscribe anytime.

Start investing safely with the Bitcoin.com Wallet

Over wallets created so far

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely

© 2026 Saint Bitts LLC Bitcoin.com. All rights reserved