Dollar-cost averaging

Last updated

Table of Contents

What is dollar-cost averaging?

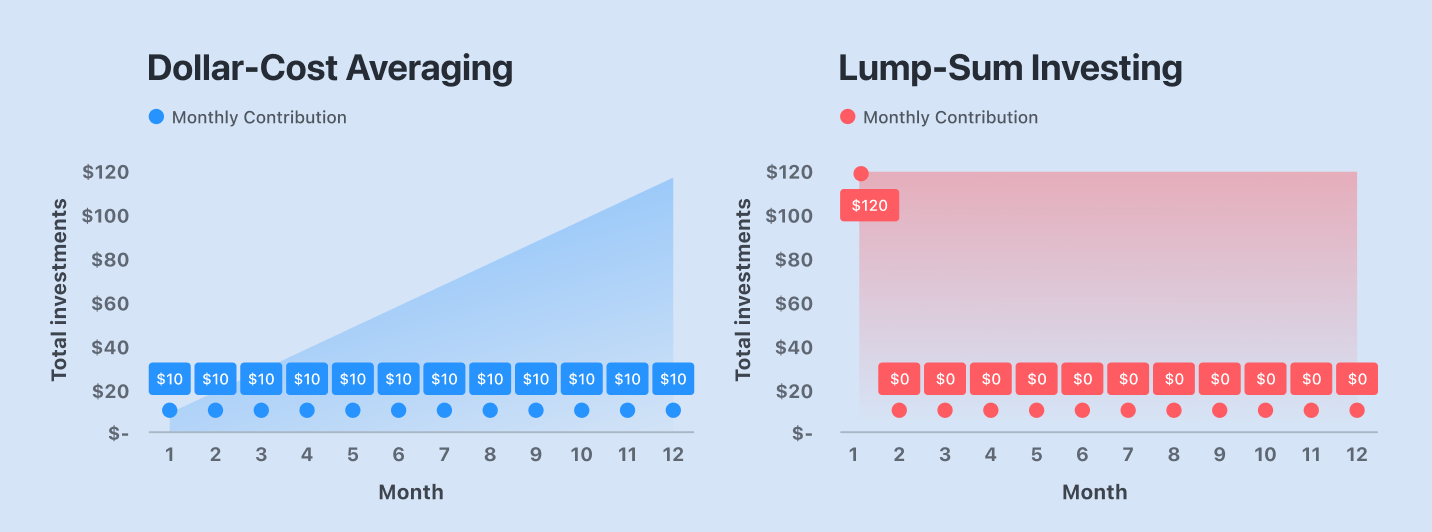

Dollar-cost averaging is an investing strategy that’s designed to protect your portfolio from market volatility (price swings). It works like this: Rather than making a single large purchase all at once, you instead make several smaller purchases over time.

Volatility in crypto

Volatility in a market refers to the amount of ups and downs in the prices of things like stocks, bonds, or cryptoassets. When there's a lot of volatility, prices can change rapidly and unpredictably. When there's low volatility, prices are more stable and don't change as much.

Different factors can cause volatility, such as news, economic events, or how people feel about the market. Volatility is important because it affects how much money people can make or lose when they invest.

Cryptocurrencies are generally considered more volatile than many other traditional asset classes, such as stocks, bonds, or commodities. Two of the main reasons for the higher volatility in cryptocurrencies are:

- Market maturity: Cryptocurrencies, being a relatively new asset class, have not yet reached the same level of maturity as traditional financial markets. The crypto market is still growing and evolving at pace far greater than traditional assets. Additionally, cryptocurrencies and other digital assets are so new, market participants do not have a lot of historical data or similar assets to compare for pricing, making price discovery uncertain.

- Market size and liquidity: The cryptocurrency market is smaller in size compared to other traditional markets. This means that when what would be small trades in traditional finance happen in crypto markets, they can have a significant impact on prices, leading to larger price swings.

Advantages of dollar-cost averaging

The benefits of dollar-cost averaging are:

- Reducing volatility: By spreading your investments over time, you reduce the effects of dramatic price swings. For example, imagine investing a large amount of money at the wrong time, like right before a market drop.

- Simplicity: It's easy to follow, and you don't need expert financial knowledge to use this strategy. Timing the market is hard even for professional traders. When you try to time the market, you attempt to buy an investment at its lowest price and sell at its highest price.

- Discipline: It encourages regular, disciplined investing, which can help build wealth over time. Long-term wealth accumulation requires investing consistently over time, taking advantage of the power of compounding, which allows your investments to grow exponentially as you reinvest your returns. This can lead to significant wealth accumulation in the long run.

- Preserve optionality: By preserving optionality, you avoid being overly committed to a single course of action, which allows you to adapt and respond to changing market conditions or new opportunities. Instead of deploying a large chunk of capital in a single purchase, dollar-cost averaging uses a fraction at one time, maintaining flexibility and keeping various options open.

Disadvantages of dollar-cost averaging

While dollar-cost averaging offers several benefits, there are some disadvantages to consider:

- Lower returns in consistently rising markets: In a market that consistently trends upward over time, dollar-cost averaging may lead to lower returns compared to investing a lump-sum at the beginning. By spreading out your investments, you may not take full advantage of the market's growth.

- Cash drag: With dollar-cost averaging, you may keep some cash on hand to invest at regular intervals. This cash may not be invested in interest-bearing accounts, leading to lower returns compared to having the entire amount invested in the market.

- Transaction costs: Regular investments may lead to higher transaction costs, such as trading fees or commissions, which can reduce your overall returns. This is particularly relevant if you invest in individual stocks or if your investment platform charges fees for each transaction.

Dollar-cost averaging strategies

The most common dollar-cost averaging strategies are passive interval-based buying strategies, for example buying daily, weekly, or monthly. There are more advanced strategies that introduce rules-based or actively managed elements. For example, adding a rule to a monthly strategy that stipulates purchases above the 34-day Exponential Moving Average (EMA), a technical indicator, should be reduced by 50%. As you can see, even adding one rule can make dollar-cost average strategies much more difficult.

Choosing the “optimal" interval, or adding rules on top of simple dollar-cost averaging strategies can eek out a couple percentage points, but for most people, using a simple interval-based strategy with a frequency of once a month is the best. There are several reasons for this:

- Advanced strategies are in essence about timing the market, which means you try to predict price movements so as to avoid buying at high prices. Basically, you need to be a trader.

- While there are some benefits with choosing shorter time intervals, the difference is smaller than you might think. Most people are used to monthly payments, such as rent/mortgage, utilities, etc… Establishing another should be easy.

Most people are already busy enough. Avoid the extra work, high levels of stress, and risk. Invest in crypto smartly with a straightforward dollar-cost average strategy. In the next section we’ll look at how dollar-cost averaging performs in two extremes of the market, “buying the top" and “catching the bottom."

Example 1 of dollar-cost averaging

Buying the top

“Buying the top" refers to the act of purchasing an asset at its highest point before it experiences a significant decline in value. While everyone wants to buy low and sell high, the problem is that it can be extremely difficult to know, at any given time, whether you’re in a peak or a trough. Let’s look at a situation where you buy the top:

We start with an initial purchase on January 1, 2018, and consider a two-year time frame. Bitcoin price at purchase: $13,657 Bitcoin price after two years: $7,200 Total investment: $2100

Scenario A: Lump-sum purchase on Jan 1, 2018

Amount of bitcoin purchased: 0.1465 BTC Value of investment after two years: $1,055 Profit/loss: -50%

Scenario B: Dollar-cost average

Purchase amount and frequency: $20/week for 105 weeks starting on Jan 1, 2018 Amount of bitcoin accumulated: 0.32 BTC Value of investment after two years: $2,327 Profit/loss: 11%

Summary

We can see that dollar-cost averaging results in a modest profit rather than a significant loss.

Example 2 of dollar-cost averaging

Catching the bottom

"Catching the bottom" refers to the practice of attempting to buy an asset at its lowest possible price during a market downturn or correction. This strategy can be very profitable if executed correctly, but it is also risky because it is difficult to accurately predict when an asset has reached its lowest point. Let’s look at a situation where you manage to catch the bottom:

Here we start with an initial purchase on January 1, 2019, and again consider a two-year time frame. Bitcoin price at purchase: $3,844 Bitcoin price after two years: $29,374 Total investment: $2100

Scenario A: Lump-sum purchase on Jan 1, 2019

Amount of bitcoin purchased: 0.52 BTC Value of investment after two years: $15,274 Profit/loss: 400%

Scenario B: Dollar-cost average

Purchase amount and frequency: $20/week for 105 weeks Amount of bitcoin accumulated: 0.2584 Value of investment after two years: $7,591 Profit/loss: 260%

Summary

We can see that dollar-cost averaging, while resulting in less profit than a lump-sum purchase, nevertheless resulted in significant gains.

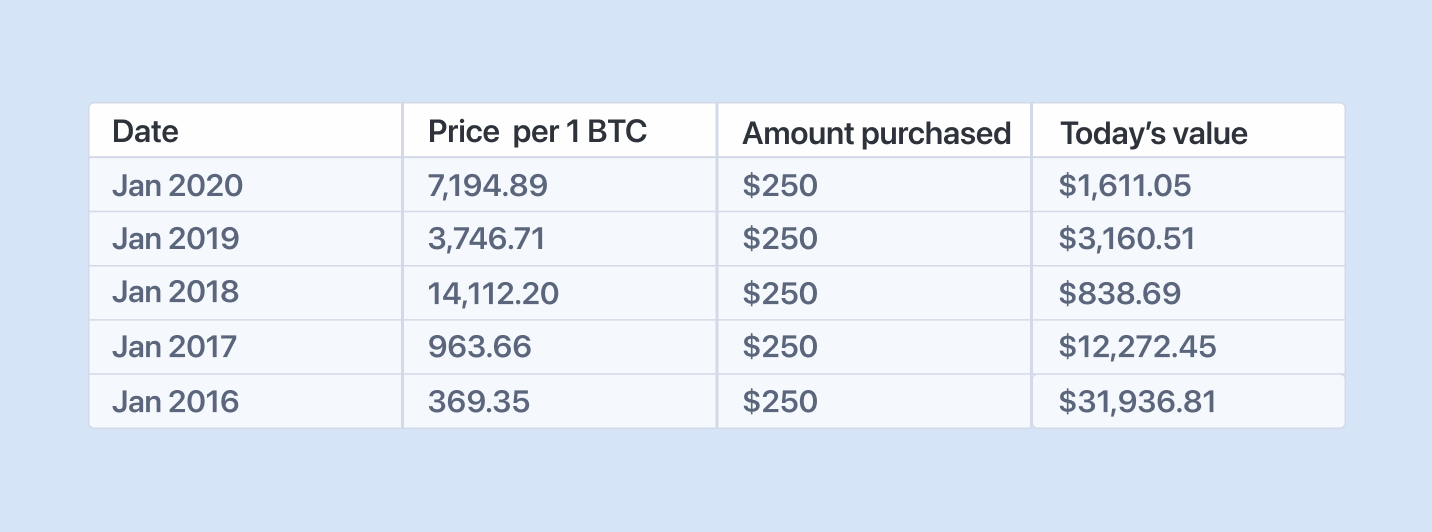

Will dollar-cost averaging always result in profit?

The short answer is no. If the asset you’re investing in never increases in value, you simply can’t make money on it. Therefore, you should only engage in a dollar-cost averaging strategy if you believe in the long-term fundamentals of an asset. That being said, for Bitcoin, dollar-cost averaging has always been a winning strategy, as the following chart helps to demonstrate:

Related guides

Start from here →

What is inflation?

Understand inflation, how it's measured, and how to protect yourself from it.

What is inflation?

Understand inflation, how it's measured, and how to protect yourself from it.

What is APY?

APY stands for annual percentage yield. It is a way to calculate interest earned on an investment that includes the effects of compound interest.

What is APY?

APY stands for annual percentage yield. It is a way to calculate interest earned on an investment that includes the effects of compound interest.

What is liquidity?

Liquidity has several slightly different but interrelated meanings. For the purposes of crypto, liquidity most often refers to financial liquidity and market liquidity.

What is liquidity?

Liquidity has several slightly different but interrelated meanings. For the purposes of crypto, liquidity most often refers to financial liquidity and market liquidity.

What are liquidity pools?

A liquidity pool is a collection of cryptoassets that help facilitate more efficient financial transactions such as swapping, lending, and earning yield.

What are liquidity pools?

A liquidity pool is a collection of cryptoassets that help facilitate more efficient financial transactions such as swapping, lending, and earning yield.

How to provide liquidity on a DEX

Learn about the importance of providing liquidity, and start earning rewards while supporting decentralized finance.

How to provide liquidity on a DEX

Learn about the importance of providing liquidity, and start earning rewards while supporting decentralized finance.

What is yield farming?

Learn what yield farming is, how it works, different types, and more.

What is yield farming?

Learn what yield farming is, how it works, different types, and more.

How to yield farm in DeFi

Learn about DeFi farming and get step-by-step instructions to earn rewards by depositing LP tokens

How to yield farm in DeFi

Learn about DeFi farming and get step-by-step instructions to earn rewards by depositing LP tokens

What is Verse?

Learn about Bitcoin.com’s official token, ways to earn it, and how to use it in the Bitcoin.com ecosystem and beyond.

What is Verse?

Learn about Bitcoin.com’s official token, ways to earn it, and how to use it in the Bitcoin.com ecosystem and beyond.

DeFi use cases

Decentralized Finance (DeFi) is bringing access to financial products to everyone. In this article we examine some prominent use cases.

DeFi use cases

Decentralized Finance (DeFi) is bringing access to financial products to everyone. In this article we examine some prominent use cases.

What is crypto lending?

Lending is a foundational activity in any financial system. Learn more about it.

What is crypto lending?

Lending is a foundational activity in any financial system. Learn more about it.

What are crypto derivatives?

Derivatives like perpetual futures and options are widely used in crypto. Learn all about them.

What are crypto derivatives?

Derivatives like perpetual futures and options are widely used in crypto. Learn all about them.

STAY AHEAD IN CRYPTO

Stay ahead in crypto with our weekly newsletter delivering the insights that matter most

Weekly crypto news, curated for you

Actionable insights and educational tips

Updates on products fueling economic freedom

No spam. Unsubscribe anytime.

Start investing safely with the Bitcoin.com Wallet

Over wallets created so far

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely

© 2026 Saint Bitts LLC Bitcoin.com. All rights reserved