What's a self-custodial wallet?

Last updated

Table of Contents

- Custodial versus self-custodial wallets

- What's the difference between self-custodial and non-custodial?

- Are all cryptocurrency wallets self-custodial?

- What are the risks associated with custodial cryptocurrency wallets?

- Are there any other reasons to use a self-custodial wallet?

- How do I know if I'm using a self-custodial wallet?

Custodial versus self-custodial wallets

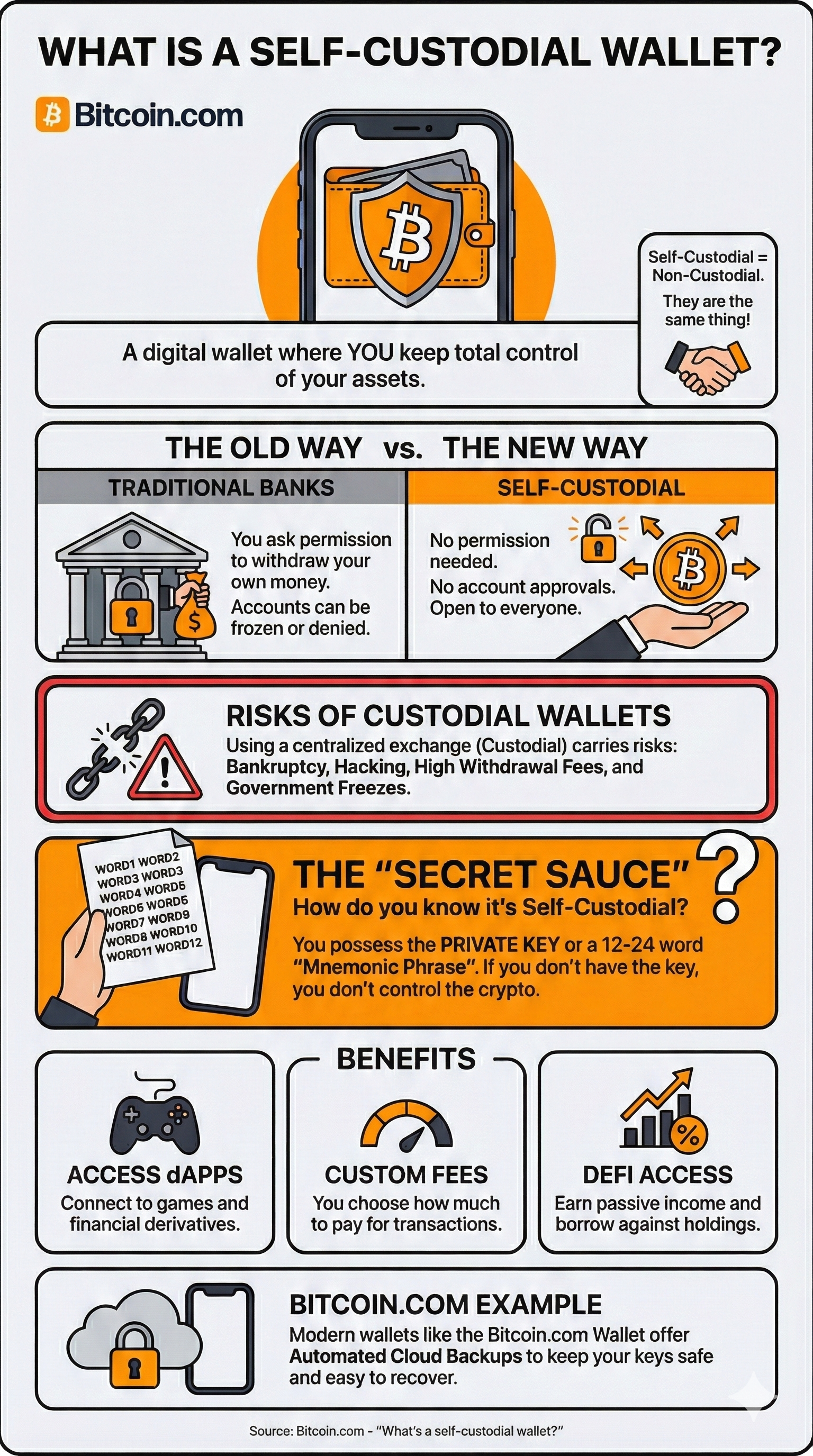

In modern finance, it's standard practice for service providers like banks to retain custody of your assets. This means, for example, that when you want to make a withdrawal from your bank account, while you may have a legal claim to the money, the reality is that you're asking for permission from your bank. Banks can and regularly do deny such permission, and their reasons for doing so do not always align with the best interests of individual customers. Furthermore, even when service providers uphold the custody rights of their customers in good faith, factors outside of their control may force them to deny you access to your money. For example, a government may force banks to restrict withdrawals in an attempt to stop runaway inflation, as happened in Greece in 2015. Another, perhaps more insidious example, is Operation Choke Point, where the US government pressured banks to deny service to people involved in a variety of (legal) industries it had identified as morally corrupt.

With the advent of blockchain-supported decentralized systems - of which Bitcoin is the primary example - it became possible, for the first time, to provide self-custodial financial services at a large scale. In the self-custodial model, the customer retains full custody (possession) of their assets at all times, using the service provider merely as an interface for conveniently managing their assets.

When you use a self-custodial wallet (like the Bitcoin.com Wallet app), first of all, you don't need to ask for permission to use the service. There's no account approval process, meaning anyone in the world can download the app and start using it immediately. Secondly, only you have access to your funds. This makes it nearly impossible for the service provider (in our case Bitcoin.com), a government, or anyone else to prevent you from using your funds exactly as you wish.

Of course, with great power comes great responsibility! In the self-custodial model, since you are the only one with access to your funds, you need to manage your wallet carefully. This includes backing up your wallet and adhering to password management best practices.

What's the difference between self-custodial and non-custodial?

Nothing. Self-custodial == non-custodial.

Are all cryptocurrency wallets self-custodial?

Absolutely not. Centralized cryptocurrency exchanges (Coinbase, Binance, etc.) provide custodial cryptocurrency wallets (sometimes known as 'web wallets'). While such exchanges are useful for buying, selling, and trading cryptoassets, when you use these exchanges, your crypto is held in trust by the exchange. Note that with self-custodial wallets like the Bitcoin.com Wallet app, you can also buy, sell, and trade cryptocurrencies.

What are the risks associated with custodial cryptocurrency wallets?

The risks are similar to (and in many cases greater than) those associated with holding your money at a bank or using a payment app like PayPal. The risks stem from the fact that, fundamentally, you are not in full control of your funds when you use a custodial wallet/account.

Firstly, you are exposed to the risk that the exchange/platform will go bankrupt. If that happens, it is highly unlikely that you will recover the crypto you held on the exchange/platform. If you do end it getting compensated, the recovery process will likely be drawn out over years, and in the end, you will receive a fraction of what the assets are worth.

Second, since taking custody of financial assets is a regulated activity, centralized cryptocurrency exchanges are subject to the whims of regulators in the jurisdiction they are domiciled -- and since cryptocurrency regulations are in a state of flux in most regions, this means there's always the possibility that you'll wake up to find you are unable to access your cryptoassets.

Next, the exchange may charge extra fees for withdrawals (which is common), slow down your withdrawal process (also common), or prevent you from withdrawing altogether (rare but not impossible).

Finally, there's the risk that the centralized exchange/platform gets hacked. If that happens, since cryptocurrency exchanges generally aren't insured and are often registered offshore, it's likely you'll lose your cryptoassets and have no recourse to action.

Are there any other reasons to use a self-custodial wallet?

Self-custodial crypto wallets provide you with direct access to public blockchains. The best wallets, like the Bitcoin.com Wallet app, allow you customize the fees you pay to public blockchain miners and validators. This means, for example, that you can choose to pay less for transactions when you're not in a hurry (or more if you're in a rush!). Finally, because self-custodial wallets provide direct access to blockchains, they also enable you to interact with smart contracts. That means, for example, you can access decentralized finance products that enable you to do things like earn passive income and borrow cryptocurrency using your holdings as collateral.

How do I know if I'm using a self-custodial wallet?

All self-custodial crypto wallets enable you (and only you) to possess the private key associated with your public address. Practically speaking, this generally takes the form of either a file you store on your device, or a 'mnemonic phrase' that consists of 12-24 randomly generated words. If your wallet doesn't have this option, it's custodial (meaning you're not in full control of your cryptoassets).

The Bitcoin.com Wallet app, which is self-custodial, also offers an automated cloud backup service (in addition to giving you the option to store the private key for each of your wallets as a mnemonic phrase). With the automated cloud backup service, you create a single custom password that decrypts a file stored in your Google Drive or Apple iCloud account, providing you with an extra layer of security as well as added convenience. If you lose access to your device, simply reinstall the Wallet app on a new device, enter your password, and you'll again have access to all of your cryptoassets. If you opt-in to the automated cloud backup service, whenever you add more wallets within your Bitcoin.com Wallet app, your backup file will automatically sync. This means you never have to worry about creating or managing a new backup for each new wallet you create!

Read more: What are the advantages of the Bitcoin.com Wallet app's automated cloud backup service?

Related guides

Start from here →

How do I create a Bitcoin wallet?

Learn how to quickly and easily create a Bitcoin wallet. Understand the different wallet types and their respective pros & cons.

How do I create a Bitcoin wallet?

Learn how to quickly and easily create a Bitcoin wallet. Understand the different wallet types and their respective pros & cons.

What is a Bitcoin wallet?

Learn about this essential tool for sending, receiving, and storing your bitcoin; how it works, and how to use it safely.

What is a Bitcoin wallet?

Learn about this essential tool for sending, receiving, and storing your bitcoin; how it works, and how to use it safely.

How do I keep my cryptoassets safe?

Make sure your cryptoassets are safe with these simple tips.

How do I keep my cryptoassets safe?

Make sure your cryptoassets are safe with these simple tips.

How do I buy Bitcoin?

A beginner-friendly guide to buying Bitcoin step by step, with simple explanations and common options.

How do I buy Bitcoin?

A beginner-friendly guide to buying Bitcoin step by step, with simple explanations and common options.

How do I send bitcoin?

Sending bitcoin is as easy as choosing the amount to send and deciding where it goes. Read the article for more details.

How do I send bitcoin?

Sending bitcoin is as easy as choosing the amount to send and deciding where it goes. Read the article for more details.

How do I receive bitcoin?

To receive bitcoin, simply provide the sender with your Bitcoin address, which you can find in your Bitcoin wallet. Read this article for more details.

How do I receive bitcoin?

To receive bitcoin, simply provide the sender with your Bitcoin address, which you can find in your Bitcoin wallet. Read this article for more details.

Crypto Tax Guide 2026

From Bitcoin to DeFi, NFTs, and staking rewards, every crypto transaction can create tax obligations. This guide explains global crypto tax rules, taxable events, and strategies to reduce liabilities.

Crypto Tax Guide 2026

From Bitcoin to DeFi, NFTs, and staking rewards, every crypto transaction can create tax obligations. This guide explains global crypto tax rules, taxable events, and strategies to reduce liabilities.

STAY AHEAD IN CRYPTO

Stay ahead in crypto with our weekly newsletter delivering the insights that matter most

Weekly crypto news, curated for you

Actionable insights and educational tips

Updates on products fueling economic freedom

No spam. Unsubscribe anytime.

Start investing safely with the Bitcoin.com Wallet

Over wallets created so far

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely

© 2026 Saint Bitts LLC Bitcoin.com. All rights reserved