বিটকয়েনের ঘর। সবার জন্য।

আপনার যা প্রয়োজন, তা হলো Bitcoin ও ক্রিপ্টো কেনা, মালিকানা এবং পরিচালনা করা - আজই আপনার আর্থিক ভবিষ্যৎ নিয়ন্ত্রণে নিন।

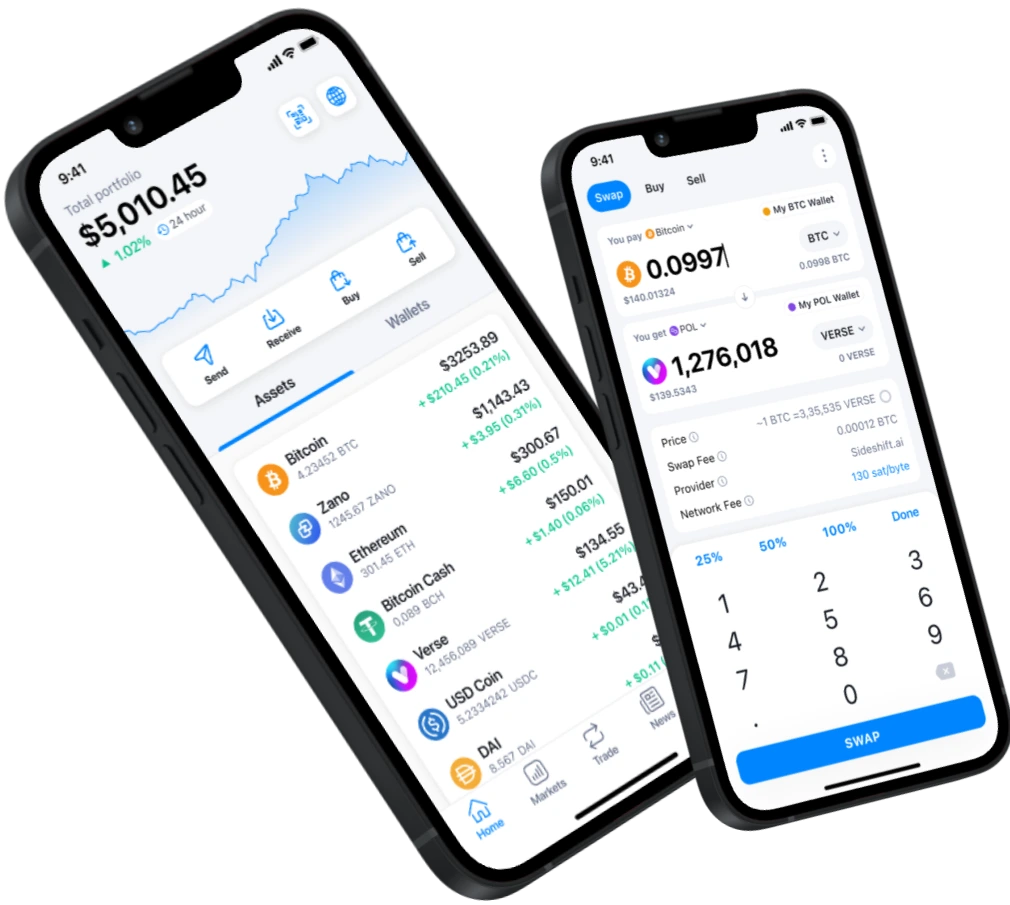

এক স্থানে ক্রিপ্টো কিনুন, বিক্রয় করুন এবং অদলবদল করুন।

নিরাপদ এবং সহজ। কোনো ডাউনলোডের প্রয়োজন নেই।

4.7

২০১৫ সাল থেকে ৭৮ মিলিয়নেরও বেশি ওয়ালেট তৈরি করা হয়েছে

বিনামূল্যের ওয়ালেট। এক্সক্লুসিভ বৈশিষ্ট্যসমূহ।

ক্রিপ্টো পরিচালনা করুন, সহজে ট্রেড করুন এবং একটি নবীন-বান্ধব মোবাইল ওয়ালেটে টোকেন পুরস্কার অর্জন করুন।

ক্রিপ্টো প্রবণতায় এগিয়ে থাকুন।

র�িয়েল-টাইম আপডেট, বিশেষজ্ঞের অন্তর্দৃষ্টি, এবং বাজার পরিবর্তনের গল্প। সব এক জায়গায়।

বড় জয় করুন। ক্রিপ্টো উপার্জন করুন। মজা করুন।

প্রমাণযোগ্যভাবে ন্যায্য গেম খেলুন এবং শীর্ষ রেটের ক্রিপ্টো ক্যাসিনো আবিষ্কার করুন। কোন KYC প্রয়োজন নেই।

আপনার ক্রিপ্টো ক্র্যাশ কোর্স এখানে শুরু হচ্ছে।

বিটকয়েনের মৌলিক বিষয় থেকে ডিফাইয়ের গভীর বিশ্লেষণ। নিজের গতিতে শিখুন, ১০০% বিনামূল্যে।

আপনার বিনিয়োগগুলি এমন একটি ওয়ালেটে সুরক্ষিত রাখুন যা কেবল আপনি অ্যাক্সেস করতে পারেন। এমনকি আমরাও নয়।

লাইভ মূল্য, চার্ট এবং বাজারের অন্তর্দৃষ্টি পান যাতে আপনি আত্ম��বিশ্বাসের সাথে ব্যবসা করতে পারেন।

১৮০টিরও বেশি দেশে ক্রিপ্টো কিনুন, বিক্রি করুন এবং অদলবদল করুন — যেকোনো সময়, যেকোনো স্থানে।

বিটকয়েন কী?

বিটকয়েন ভবিষ্যতের জন্য ডিজাইন করা একটি ডিজিটাল মুদ্রা।

এর ব্যবহার বিশ্বব্যাপী বৃদ্ধি পাওয়ায়, এটি ভবিষ্যৎ-প্রমাণ সম্পদ খুঁজতে থাকা যে কোনো বিনিয়োগ পোর্টফোলিওর জন্য একটি অপরিহার্য সংযোজন হয়ে উঠছে।

বর্তমান মূল্য

বিটকয়েনের দুর্লভতা সোনা বা S&P 500 এর তুলনায় উচ্চতর বৃদ্ধির সম্ভাবনা প্রদান করে।

বিটকয়েন ভবিষ্যতের জন্য ডিজাইন করা একটি ডিজিটাল মুদ্রা।

এর ব্যবহার বিশ্বব্যাপী বৃদ্ধি পাওয়ায়, এটি ভবিষ্যৎ-প্রমাণ সম্পদ খুঁজতে থাকা যে কোনো বিনিয়োগ পোর্টফোলিওর জন্য একটি অপরিহার্য সংযোজন হয়ে উঠছে।

বর্তমান মূল্য

বিটকয়েনের দুর্লভতা সোনা বা S&P 500 এর তুলনায় উচ্চতর বৃদ্ধির সম্ভাবনা প্রদান করে।

কেন্দ্রীয় ব্যাংকগুলোর নিয়ন্ত্রণ নেই

উচ্চ রিটার্নের জন্য শক্তিশালী সম্ভাবনা

নিরাপদ লেনদেনসমূহ

আপনার সর্ব-ইন-ওয়ান Bitcoin প্ল্যাটফর্ম

আমরা বিটকয়েন এবং ক্রিপ্টো সবার জন্য সহজলভ্য করে তুলি। আপনি কিনত�ে, বিক্রি করতে, লেনদেন করতে, সংরক্ষণ করতে বা আয় করতে চাইলে, আমাদের টুল এবং পরিষেবাগুলি আপনাকে নিয়ন্ত্রণে রাখে — কোনো জটিল প্রক্রিয়া বা মধ্যস্থতাকারীর প্রয়োজন নেই।

বিটকয়েন পান

আপনার গণতন্ত্রায়িত অর্থের প্রবেশদ্বার

বিটকয়েন কিনুন এবং বিক্রি করুন

দ্রুত সেটআপ, নমনীয় পেমেন্ট, কম ফি — প্রতিটি ধাপে গাইড করা হয়।

বিটকয়েন কিনুন

বিটকয়েন.কম অ্যাপ

একটি অল-ইন-ওয়ান ওয়ালেট যা দিয়ে Bitcoin (এবং অন্যান্য শীর্ষ ক্রিপ্টোকারেন্সি) কেনা, বাণিজ্য করা এবং সংরক্ষণ করা যায় — নিরাপদ, সহজবোধ্য এবং সম্পূর্ণ আপনার নিয়ন্ত্রণে।

এখন ডাউনলোড করুন

বিটকয়েন.কম অ্যাকাউন্ট

যেকোনো সময়, যেকোনো স্থানে নির্বিঘ্ন এবং সুরক্ষিত ক্রিপ্টো পরিচালনা। একটি প্রাইভেট কী হারানোর বিষয়ে কোনো চিন্তা নেই।

অ্যাকাউন্ট তৈরি করুন

আয় করুন ও বৃদ্ধি করুন

ইল্ড এবং পুরস্কারের মাধ্যমে বিটকয়েন উপার্জন করুন। সাইন-আপ বোনাস আনলক করুন এবং আপনার পোর্টফোলিও বাড়ান।

আয় করা শুরু করুন

সমস্ত ক্রিপ্টো বিষয়ের সূচক

আমাদের বিশেষজ্ঞ দলের দ্বারা পর্যালোচনা এবং সংক্ষেপিত সেরা এক্সচেঞ্জ, ক্রিপ্টো কার্ড, আইগেমিং সাইট এবং ক্রিপ্টো-বন্ধব ব্যবসা আবিষ্কার করুন।

এখনই অনুসন্ধান করুনট্রেন্ডিং সংবাদ

আপডেট কখনো মিস করবেন না — দৈনিক ক্রিপ্টো শিরোনাম এবং বিশ্লেষণের সাথে আপডেট থাকুন।

মাস্টারকার্ড® গৃহীত হয় এমন যেকোনো স্থানে ব্যয় করুন।

বিশ্বব্যাপী এটিএম থেকে নগদ অর্থ উত্তোলন করুন

ক্রিপ্টো দিয়ে আপনার কার্ড রিচার্জ করুন।

ক্রিপ্টো থেকে ক্যাশে দ্রুত পরিবর্তন

কার্ড পান

ক্রিপ্টো গ্রহণকারী ব্যবসা ও পরিষেবার উপর বিশেষজ্ঞ পর্যালোচনা আবিষ্কার করুন।

এখনই আবিষ্কার করুন

মাস্টারকার্ড® গৃহীত হয় এমন যেকোনো স্থানে ব্যয় করুন।

বিশ্বব্যাপী এটিএম থেকে নগ�দ অর্থ উত্তোলন করুন

ক্রিপ্টো দিয়ে আপনার কার্ড রিচার্জ করুন।

ক্রিপ্টো থেকে ক্যাশে দ্রুত পরিবর্তন

কার্ড পান

মানচিত্র

ক্রিপ্টো গ্রহণকারী ব্যবসা ও পরিষেবার উপর বিশেষজ্ঞ পর্যালোচনা আবিষ্কার করুন।

এখনই আবিষ্কার করুন

ক্রিপ্টোকারেন্সি ট্রেডিংয়ের জন্য সেরা প্ল্যাটফর্মগুলি আবিষ্কার করু�ন

সেরা ক্রিপ্টো এক্সচেঞ্জ

সর্বনিম্ন ফি, দ্রুততম মোবাইল অভিজ্ঞতা, সমর্থিত মুদ্রার সর্বাধিক পরিসর এবং আরও অনেক কিছু।

সেরা বিটকয়েন এক্সচেঞ্জ

বিটকয়েন ট্রেডিং জোড়ায় কোনো ফি নেই, বিটকয়েন স্টেকিংয়ের সর্বোচ্চ APY এবং সর্বোচ্চ লিকুইডিটি।

সেরা P2P এক্সচেঞ্জ

সেরা রেট, সর্বোচ্চ নিরাপত্তা এবং সমর্থিত দেশ ও পেমেন্ট পদ্ধতির সর্বাধিক পরিসর।

সব এক্সচেঞ্জ রিভিউ দেখুন...

ক্রিপ্টোকারেন্সি ট্রেডিংয়ের জন্য সেরা প্ল্যাটফর্মগুলি আবিষ্কার করুন

সহজে বিনিয়োগ পরিচালনার জন্য উপযুক্ত ক্রিপ্টো ওয়ালেট খুঁজে নিন

সেরা ক্রিপ্টো ক্যাসিনো, বেটিং প্ল্যাটফর্ম এবং ওয়েলকাম বোনাস আবিষ্কার করুন

ব্যবহারকারীর মতামত

আমাদের সুনাম বিশ্বাসের উপর প্রতিষ্ঠিত। সহকর্মী ব্যবহারকারীদের দ্বারা দেওয়া প্রকৃত প্রতিক্রিয়া এবং যাচাইযোগ্য পর্যালোচনাগুলি অন্বেষণ করুন।

Easy to use crypto wallet, quick fast service and self tested sends and receives. Amazing wallet with neat resources that allow even begginers' to get a good concept of how to keep move and store your coins. A+ wallet. Thank you for your service.

ব্র্যাড লি স্টেসি

Bitcoin.com is the most convenient app to use for cryptocurrencies such as btc bch and eth.. i always use this app.. easy to use no kyc needed.. it helps me track my earnings. Updates are easy to learn.

এন্ড কেএ টুইন্স

I love this app I finally found one I can understand

বিটকয়েন ব্যবহারকারী

One of the best. I enjoy the ease of use and the ability to transfer and receive without a lot of red tape or high bank fees.

রিচার্ড ডব্বার

I've been using Bitcoin.com wallet for awhile now. They have a done a great job in terms of ease of use and security.

হোসেন আমিন

I think Bitcoin.com is probably the best at what they do regarding making things simplistic for a form of technology that is quite complicated.

ক্রিস্টোফার ম্যাককার্টনি

Easy to use app. The transfer is real time. Would definitely recommend to my friends.

ইয়িং ইয়াং

Great site for checking crypto prices and my preferred mobile app for holding Bitcoin Cash and Bitcoin. Great company doing a lot to drive adoption and use of crypto.

পল

ID Verification went smoothly transaction fees are low and easy app to navigate

টম কিং

sent and received successfully thanks to customer service support for assisting and offering support quickly and satisfactorily!

জেমিডিপাওয়েল

টোকেন ন্যারেটিভস

সর্বশেষ অন্তর্দৃষ্টি, প্রবণতা এবং উল্লেখযোগ্য টোকেনের ঘিরে গভীর আলোচনার সাথে আপডেট থাকুন, যা আপনাকে ক্রিপ্টোকারেন্সির জগতে অবগত এবং অগ্রগামী থাকতে সাহায্য করে।

এখনও প্রশ্ন আছে?

আমাদের সাহায্য কেন্দ্র পরিদর্শন করুন

সবচেয়ে সাধারণ প্রশ্নগুলির জন্য দ্রুত স্পষ্ট এবং সংক্ষিপ্ত উত্তর খুঁজে পান।

সাপোর্টের সাথে চ্যাট করুন

আমাদের দল আপনার জন্য ২৪/৭ সময় এখানে রয়েছে, আপনার যেকোনো প্রয়োজনের জন্য সাহায্য করতে প্রস্তুত — যে কোনো সময়, যে কোনো দিন।

টিউটোরিয়াল ও গাইডস

আপনার সময় নিন এবং ধাপে ধাপে নির্দেশিকা সহ সম্পদগুলির মাধ্যমে দক্ষতা গড়ে তুলুন।

শুরু করার জন্য প্রস্তুত?

বিটকয়েন.কম এ যোগ দিন এবং জানতে পারবেন কত সহজে আপনি আপনার বিটকয়েনের মালিক হতে পারেন, পরিচালনা করতে পারেন এবং বৃদ্ধি করতে পারেন।

স্পষ্টতই

© ২০২৫ সেন্ট বিটস এলএলসি Bitcoin.com। সর্বস্বত্ব সংরক্ষিত।